Question: 1) Olay Co. has $3mi net operating working capitai and $30mi net fixed assets. It has sales of $35mi, costs of $20mi, depreciation expense of

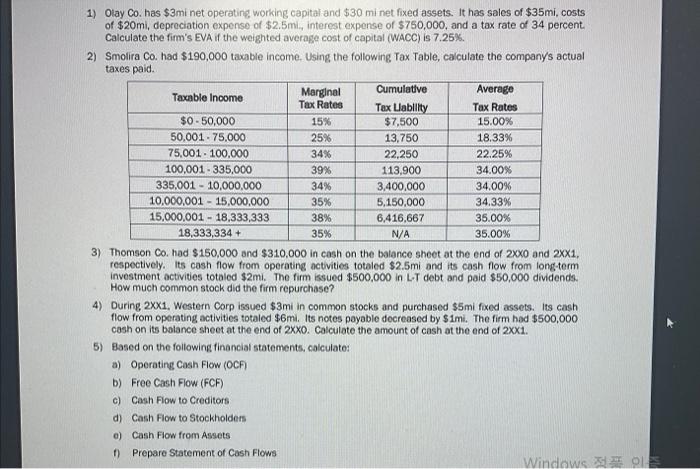

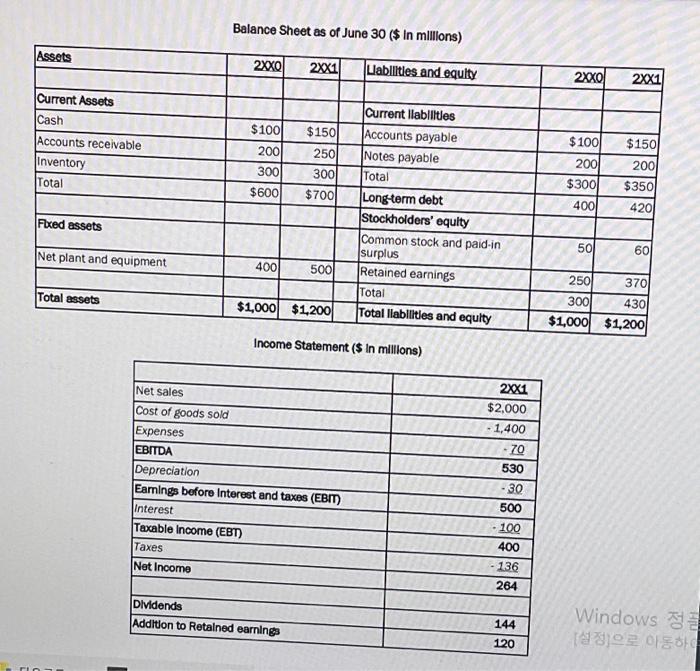

1) Olay Co. has $3mi net operating working capitai and $30mi net fixed assets. It has sales of $35mi, costs of $20mi, depreciation expense of $2.5mi, interest expense of $750,000, and a tax rate of 34 percent. Calculate the firm's EVA if the weighted average cost of capital (WACC) is 7.25%. 2) Smolira Co. had $190,000 taxable income. Using the following Tax Table, calculate the companys actual taxes paid. 3) Thomson Co. had $150,000 and $310,000 in cash on the balance sheet at the end of 20 and 21, respectively. Its cash flow from operating activities totaled $2.5mi and its cash flow from longterm investment activities totaled $2mi. The firm issued $500,000 in L.T debt and paid $50,000 dividends. How much common stock did the firm repurchase? 4) During 21. Western Corp issued $3mi in common stocks and purchased $5mi fixed assets. Its cash flow from operating activities totaled $6mi. Its notes payable docreased by $1mi. The firm had $500,000 cash on its bolance sheet at the end of 20. Calculate the amount of cash at the end of 21. 5) Based on the following financial statements, calculates a) Operating Cash Flow (OCF) b) Free Cash Flow (FCF) c) Cash Flow to Creditors d) Cash Flow to Stockholders e) Cash Flow from Assets f) Prepare Statement of Cash Flows Balance Sheet as of June 30 ( $ In millions) Income Statement (\$ in millions)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts