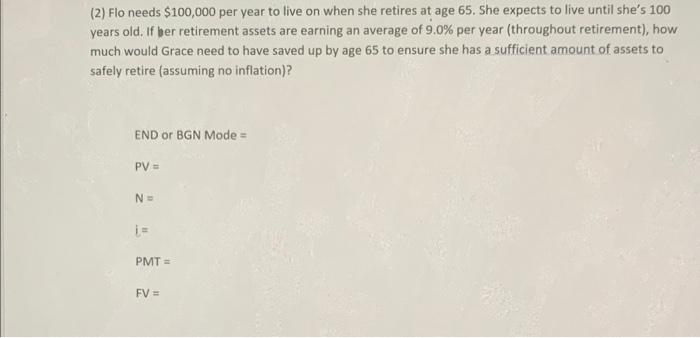

Question: (2) Flo needs $100,000 per year to live on when she retires at age 65 . She expects to live until she's 100 years old.

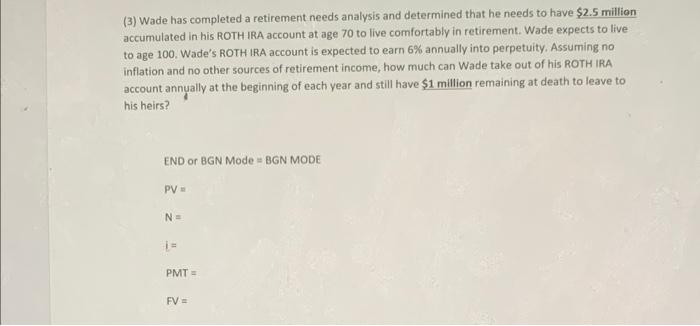

(2) Flo needs $100,000 per year to live on when she retires at age 65 . She expects to live until she's 100 years old. If ber retirement assets are earning an average of 9.0% per year (throughout retirement), how much would Grace need to have saved up by age 65 to ensure she has a sufficient amount of assets to safely retire (assuming no inflation)? (3) Wade has completed a retirement needs analysis and determined that he needs to have $2.5 million accumulated in his ROTH IRA account at age 70 to live comfortably in retirement. Wade expects to live to age 100 . Wade's ROTH IRA account is expected to earn 6% annually into perpetuity. Assuming no inflation and no other sources of retirement income, how much can Wade take out of his ROTH IRA account annually at the beginning of each year and still have $1 million remaining at death to leave to his heirs? END or BGN Mode =BGN MODE PV = N= i = PMT = FV=

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts