Question: 2 For this question, you should use the standard Black Scholes model for the market described above; the parameters should be appropriately chosen so as

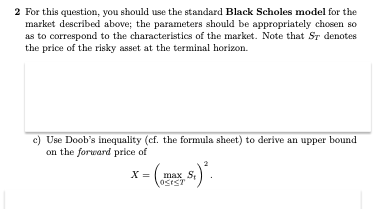

2 For this question, you should use the standard Black Scholes model for the market described above; the parameters should be appropriately chosen so as to correspond to the characteristics of the market. Note that Sr denotes the price of the risky asset at the terminal horizon. c) Use Doob's inequality (cf. the formula sheet) to derive an upper bound on the forward price of X = max S OSTS 4.5). 2 For this question, you should use the standard Black Scholes model for the market described above; the parameters should be appropriately chosen so as to correspond to the characteristics of the market. Note that Sr denotes the price of the risky asset at the terminal horizon. c) Use Doob's inequality (cf. the formula sheet) to derive an upper bound on the forward price of X = max S OSTS 4.5)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts