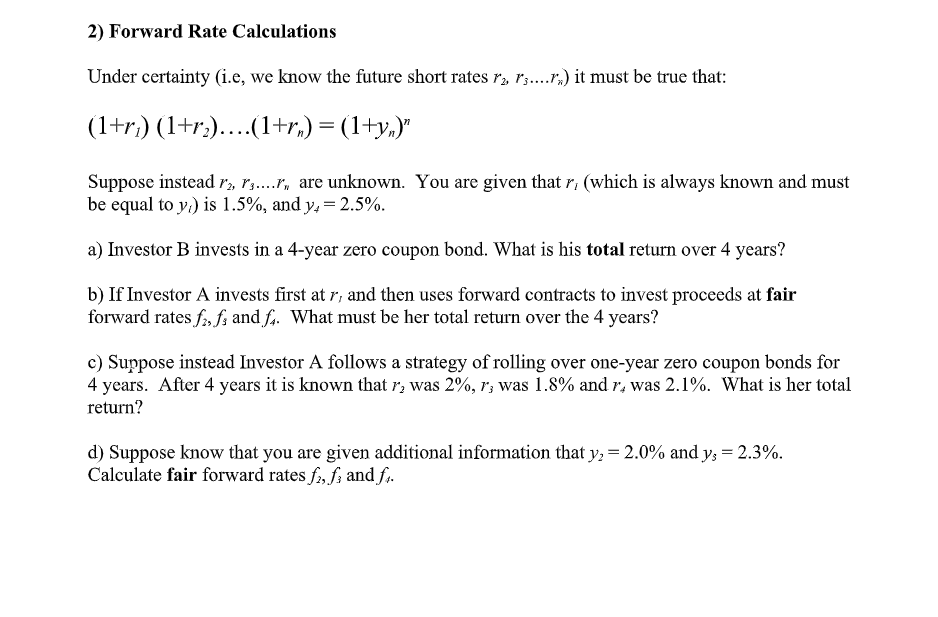

Question: 2) Forward Rate Calculations Under certainty (i.e, we know the future short rates ru, rs....) it must be true that: (1+r) (1+r)....(1+rn) = (1+yn) Suppose

2) Forward Rate Calculations Under certainty (i.e, we know the future short rates ru, rs....) it must be true that: (1+r) (1+r)....(1+rn) = (1+yn)" Suppose instead r, 13...., are unknown. You are given that r, (which is always known and must be equal to y) is 1.5%, and y4 = 2.5%. a) Investor B invests in a 4-year zero coupon bond. What is his total return over 4 years? b) If Investor A invests first at r, and then uses forward contracts to invest proceeds at fair forward rates f2, f; and f,. What must be her total return over the 4 years? c) Suppose instead Investor A follows a strategy of rolling over one-year zero coupon bonds for 4 years. After 4 years it is known that r, was 2%, r; was 1.8% and r, was 2.1%. What is her total return? d) Suppose know that you are given additional information that y; = 2.0% and y; = 2.3%. Calculate fair forward rates f2, f; and f.. 2) Forward Rate Calculations Under certainty (i.e, we know the future short rates ru, rs....) it must be true that: (1+r) (1+r)....(1+rn) = (1+yn)" Suppose instead r, 13...., are unknown. You are given that r, (which is always known and must be equal to y) is 1.5%, and y4 = 2.5%. a) Investor B invests in a 4-year zero coupon bond. What is his total return over 4 years? b) If Investor A invests first at r, and then uses forward contracts to invest proceeds at fair forward rates f2, f; and f,. What must be her total return over the 4 years? c) Suppose instead Investor A follows a strategy of rolling over one-year zero coupon bonds for 4 years. After 4 years it is known that r, was 2%, r; was 1.8% and r, was 2.1%. What is her total return? d) Suppose know that you are given additional information that y; = 2.0% and y; = 2.3%. Calculate fair forward rates f2, f; and f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts