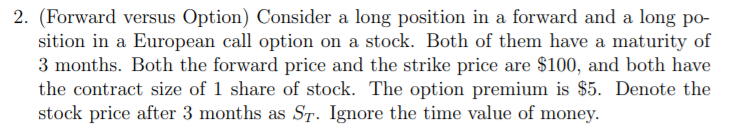

Question: 2. (Forward versus Option) Consider a long position in a forward and a long po- sition in a European call option on a stock. Both

2. (Forward versus Option) Consider a long position in a forward and a long po- sition in a European call option on a stock. Both of them have a maturity of 3 months. Both the forward price and the strike price are $100, and both have the contract size of 1 share of stock. The option premium is $5. Denote the stock price after 3 months as St. Ignore the time value of money. (a) If St = $105, which long position provides a higher net profit, the forward or the option? (b) For what values of St does the long position in forward contract provide a higher net profit than the option contract? (c) Consider a portfolio consisting of a long position of 1 European call option as above, and a long position of 1 European put option with the same strike price, underlying stock, maturity, and premium. For what values of Sy does this portfolio have a positive net profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts