Question: Solve a,b (Forward versus Option. Consider a long position in one forward contract and a long position in one European call option on a stock.

Solve a,b

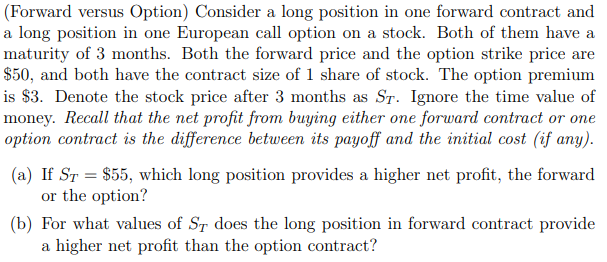

(Forward versus Option. Consider a long position in one forward contract and a long position in one European call option on a stock. Both of them have a maturity of 3 months. Both the forward price and the option strike price are $50, and both have the contract size of 1 share of stock. The option premium is $3. Denote the stock price after 3 months as St. Ignore the time value of money. Recall that the net profit from buying either one forward contract or one option contract is the difference between its payoff and the initial cost (if any). (a) If St = $55, which long position provides a higher net profit, the forward or the option? (b) For what values of St does the long position in forward contract provide a higher net profit than the option contract? (Forward versus Option. Consider a long position in one forward contract and a long position in one European call option on a stock. Both of them have a maturity of 3 months. Both the forward price and the option strike price are $50, and both have the contract size of 1 share of stock. The option premium is $3. Denote the stock price after 3 months as St. Ignore the time value of money. Recall that the net profit from buying either one forward contract or one option contract is the difference between its payoff and the initial cost (if any). (a) If St = $55, which long position provides a higher net profit, the forward or the option? (b) For what values of St does the long position in forward contract provide a higher net profit than the option contract

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts