Question: 2. George, age 50, is considering purchasing two annuities: -- A 20-year annuity certain with an annual benefit of $10,000 payable continuously, or -- A

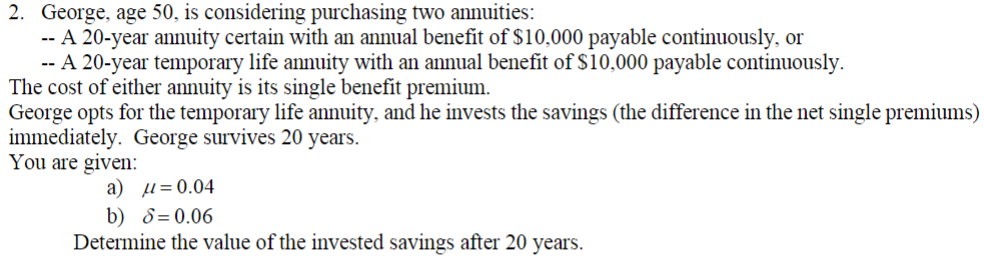

2. George, age 50, is considering purchasing two annuities: -- A 20-year annuity certain with an annual benefit of $10,000 payable continuously, or -- A 20-year temporary life annuity with an annual benefit of $10,000 payable continuously. The cost of either annuity is its single benefit premium. George opts for the temporary life annuity, and he invests the savings (the difference in the net single premiums) immediately. George survives 20 years. You are given: a) != 0.04 b) 8=0.06 Determine the value of the invested savings after 20 years. 2. George, age 50, is considering purchasing two annuities: -- A 20-year annuity certain with an annual benefit of $10,000 payable continuously, or -- A 20-year temporary life annuity with an annual benefit of $10,000 payable continuously. The cost of either annuity is its single benefit premium. George opts for the temporary life annuity, and he invests the savings (the difference in the net single premiums) immediately. George survives 20 years. You are given: a) != 0.04 b) 8=0.06 Determine the value of the invested savings after 20 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts