Question: George, aged 5 0 , is considering purchasing two annuities: ( i ) a 2 0 - year annuity certain with an annual benefit of

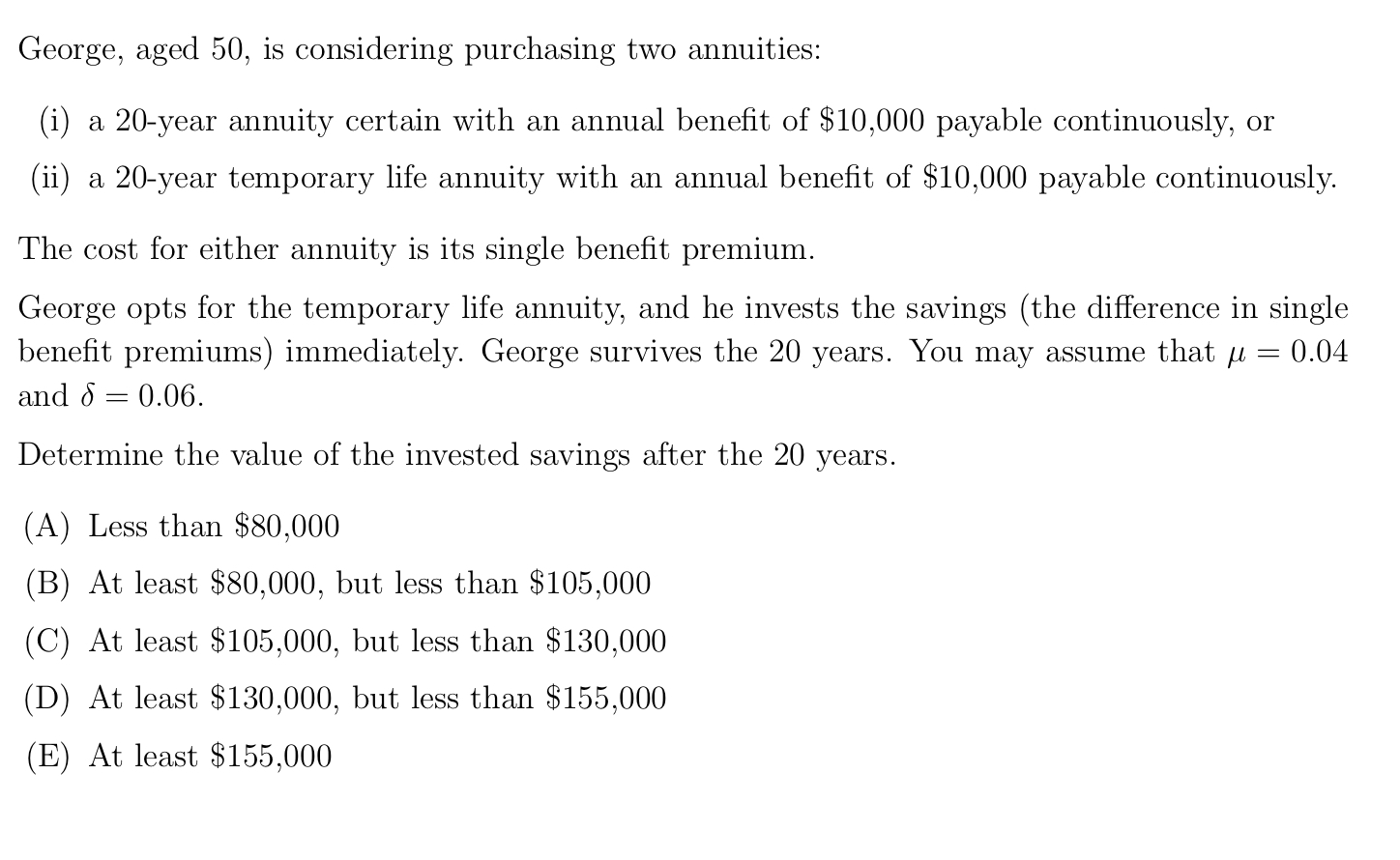

George, aged is considering purchasing two annuities:

i a year annuity certain with an annual benefit of $ payable continuously, or

ii a year temporary life annuity with an annual benefit of $ payable continuously.

The cost for either annuity is its single benefit premium.

George opts for the temporary life annuity, and he invests the savings the difference in single benefit premiums immediately. George survives the years. You may assume that and

Determine the value of the invested savings after the years.

A Less than $

B At least $ but less than $

C At least $ but less than $

D At least $ but less than $

E At least $

The final answer is $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock