Question: 2. Given the income statement for the MLC (Table 4-7) and balance sheet (Table 4-4), answer the following: a. In a written explanation, describe what

2. Given the income statement for the MLC (Table 4-7) and balance sheet (Table 4-4), answer the following:

a. In a written explanation, describe what each of these ratios means, by definition and for MLC:

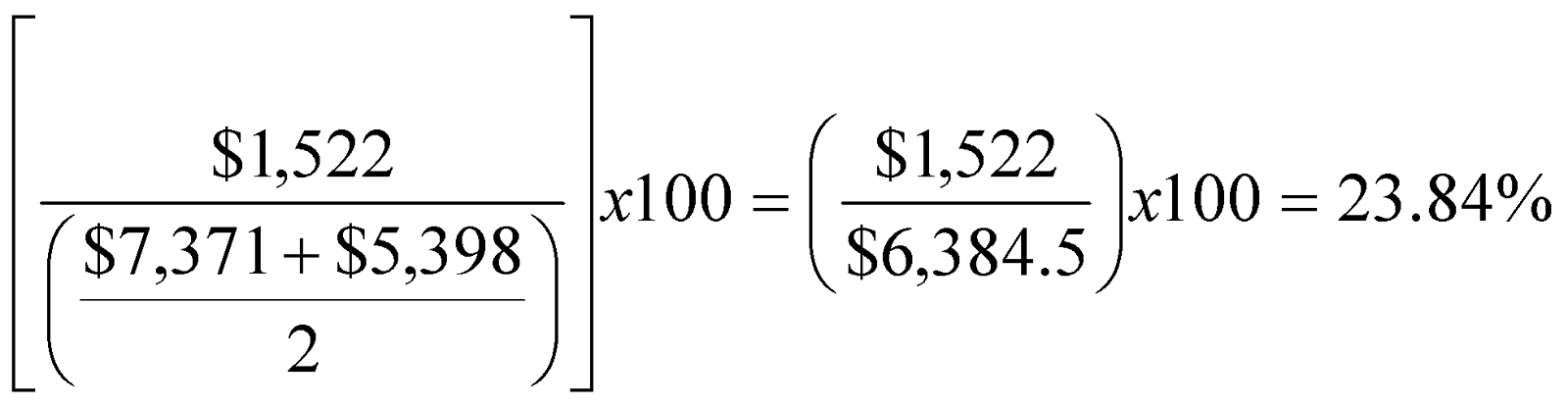

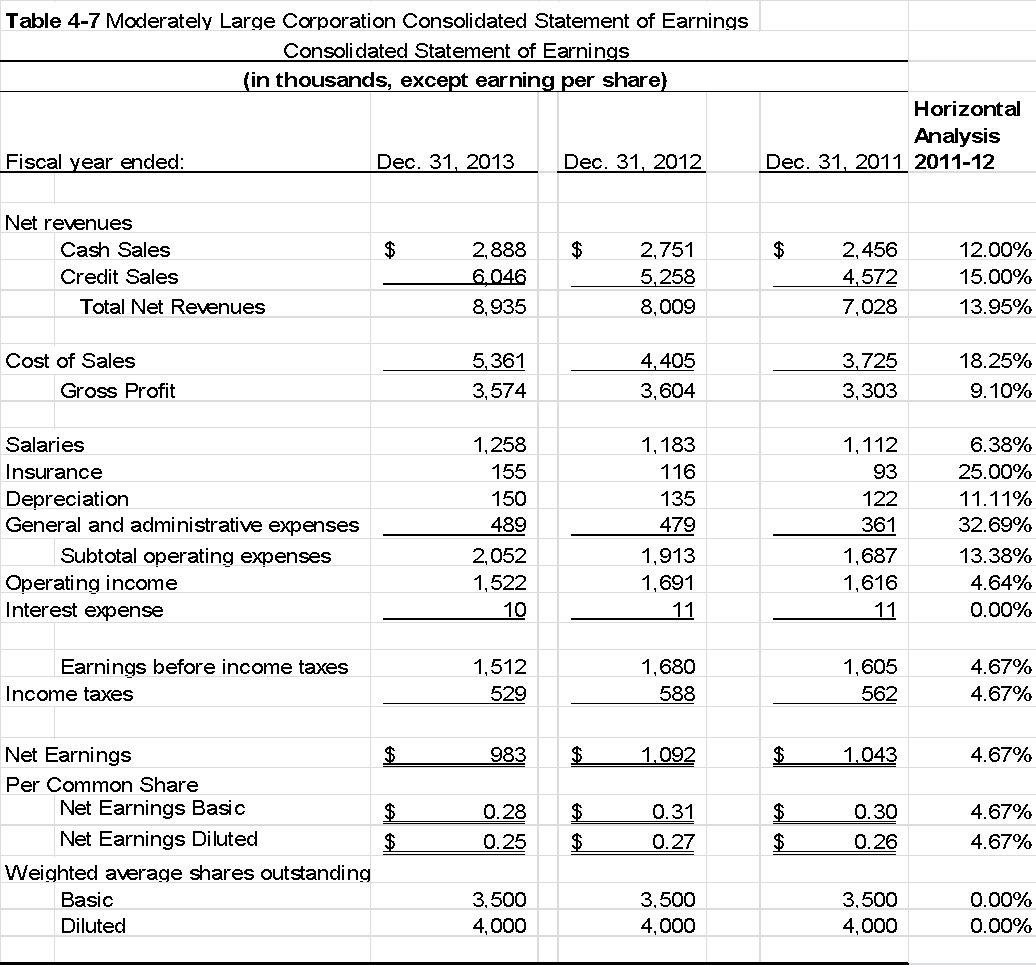

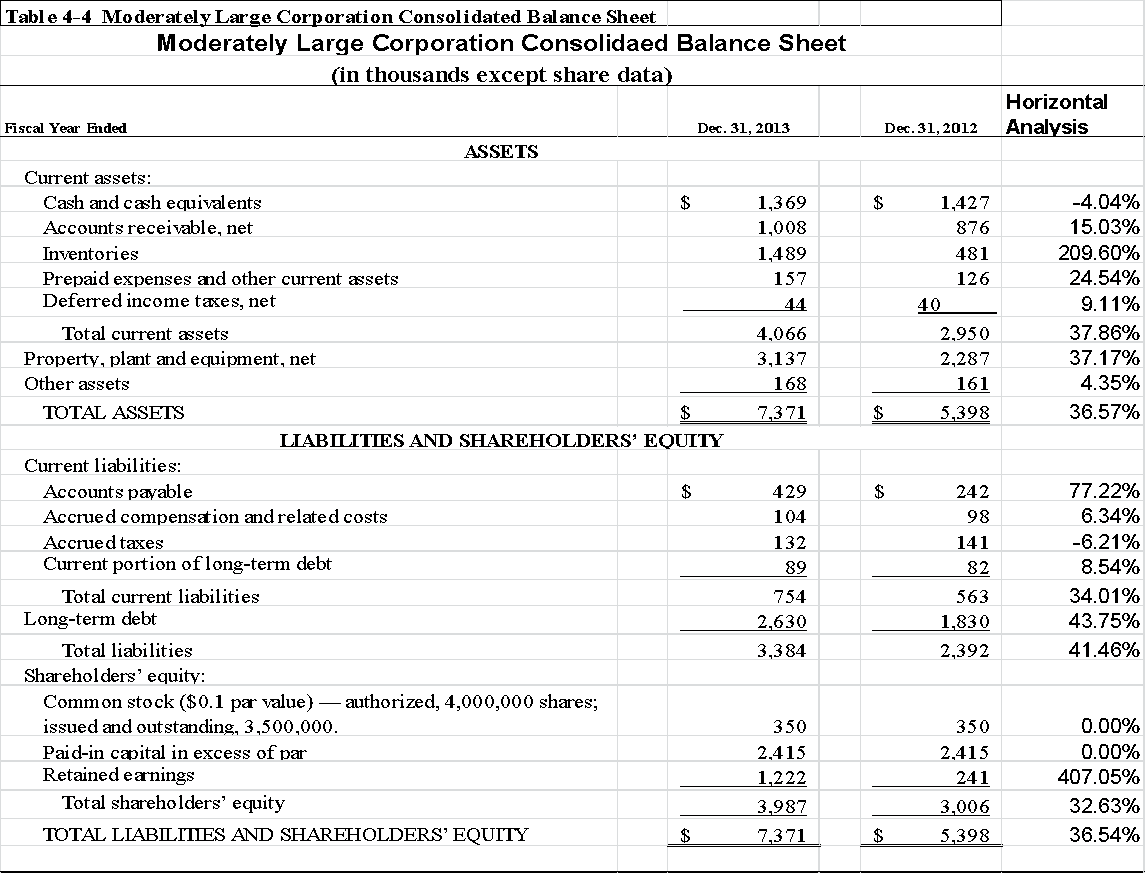

\fTable 4-7 Moderately Large Corporation Consolidated Statement of Earnings Consolidated Statement of Earnings (in thousands, except earning per share) Horizontal Analysis Fiscal year ended: Dec. 31, 2013 Dec. 31, 2012 Dec. 31, 2011 2011-12 Net revenues Cash Sales $ 2, 888 $ 2,751 $ 2,456 12.00% Credit Sales 6 046 5,258 4,572 15.00% Total Net Revenues 8,935 8,009 7,028 13.95% Cost of Sales 5,361 4,405 3,725 18.25% Gross Profit 3,574 3,604 3,303 9. 10% Salaries 1,258 1, 183 1, 112 6.38% Insurance 155 116 93 25.00% Depreciation 150 135 122 11.11% General and administrative expenses 489 479 36 32.69% Subtotal operating expenses 2,052 1,913 1,687 13.38% Operating income 1,522 1,691 1,616 4.64% Interest expense 10 11 11 0.00% Earnings before income taxes 1,512 1,680 1,605 4.67% Income taxes 529 588 562 4.67% Net Earnings 983 1,092 1,043 4.67% Per Common Share Net Earnings Basic 0.28 0.31 $ 0.30 4.67% Net Earnings Diluted 0.25 0.27 0.26 4.67% Weighted average shares outstanding Basic 3, 500 3. 500 3.500 0.00% Diluted 4,000 4, 000 4,000 0.00%Table 4-4 Moderately Large Corporation Consclidated Balance Sheet Moderately Large Corporation Consolidaed Balance Sheet (in thousands except share data) Horizontal Fiscal Year Fnded Dec. 31,2013 Dec.31,2012 Analysis ASSETS Current aszets: Cash and cash equivalents 5 1,369 5 1427 -4.04% Accounts receivable, net 1,008 876 15.03% Inventories 1,489 481 209.60% Prepaid expenses and other current assets 157 126 24.54% Deferred income taxes, net a4 40 9.11% Total current assets 1.066 2.950 37.86% Property, plant and equipment, net 3,137 2,287 3717% Other assets 168 161 4.35% TOTAL ASSETS 5 7.371 5 5,398 36.57% LIABILITIES AND SHAREHOLDERS EQUITY Current liabilities: Accounts payable 5 429 5 242 77.22% Accrued compensdiocn and related costs 104 98 6.34% Accrued taxes 132 141 -6.21% Current portion of long-term debt 89 82 8.54% Total current liabilities 754 563 34.01% Long-term debt 2,630 1,830 43.75% Total liabilities 3.354 2,392 41.46% Shareholders' equity: Common stock ($0.1 par value} authorized, 4,000,000 shares; issued and outstanding, 3,500,000, 350 350 0.00% Paid-in capital in excess of par 2.415 2.415 0.00% Retained earnings 1.222 241 407.05% Total shareholders' equity 3,987 3,006 32.63% TOTAL LIABILTIIES AND SHAREHOLDERS EQUITY 5 7371 5 5.398 36.54%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts