Question: 2. How much life insurance do you need? Calculating needs - Part1 Nathan and Marissa Azinian are 52 years old and have one son, age

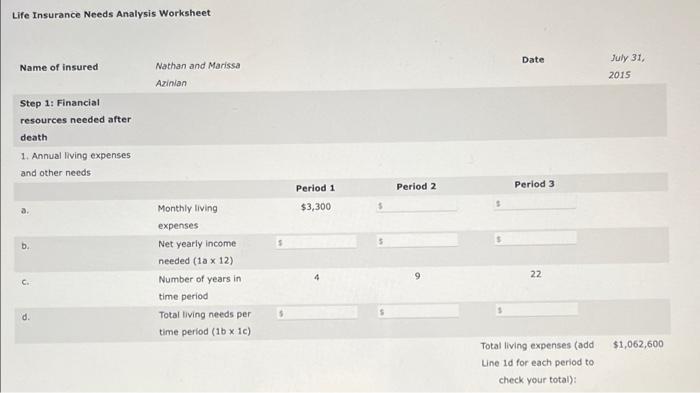

2. How much life insurance do you need? Calculating needs - Part1 Nathan and Marissa Azinian are 52 years old and have one son, age 14. Nathan is the primary earner, making $80,000 per year. Marissa does not currently work. The Azinians have decided to use the needs analysis method to calculate the value of a life insurance policy that would provide for Marissa and their son in the event of Nathan's death. Nathan and Marissa estimate that while their son is still living at home, monthly living expenses for Marissa and their child will be about $3,300 (in current dollars). After their son leaves for college in 4 years, Marissa will need a monthly income of $2,750 until she retires at age 65. The Azinians estimate Marissa's living expenses after 65 will only be $2,300 a month. The life expectancy of a woman Marissa's age is 87 years, so the Azinian family calculates that Marissa will spend about 22 years in retirement. Using this information, complete the first portion of the needs analysis worksheet to estimate their total living expenses. Life Insurance Needs Analysis Worksheet Name of insured Step 1: Financial resources needed after death 1. Annual living expenses Nathan and Marissa Azinian Date July 31, 2015 Life Insurance Needs Analysis Worksheet Name of insured Step 1: Financial resources needed after death 1. Annual living expenses and other needs 6 d. Nathan and Marissa Azinian Monthly living expenses Net yearly income needed (1a x 12) Number of years in time period Total living needs per time period (1b x 1c) Period 1 $3,300 $ Period 2 Date Period 3 22 Total living expenses (add Line 1d for each period to check your total): July 31, 2015 $1,062,600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts