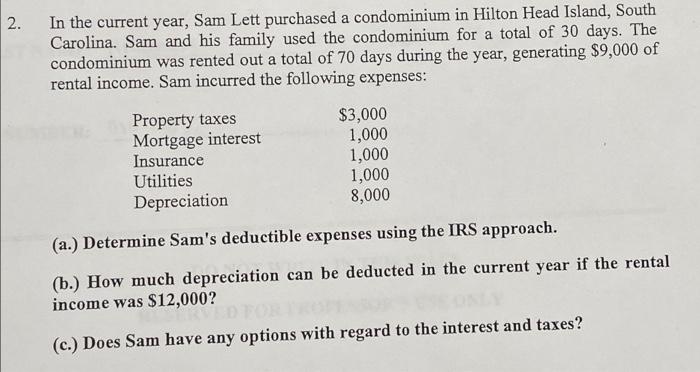

Question: 2. In the current year, Sam Lett purchased a condominium in Hilton Head Island, South Carolina. Sam and his family used the condominium for a

2. In the current year, Sam Lett purchased a condominium in Hilton Head Island, South Carolina. Sam and his family used the condominium for a total of 30 days. The condominium was rented out a total of 70 days during the year, generating $9,000 of rental income. Sam incurred the following expenses: $3,000 1,000 1,000 1,000 8,000 Property taxes Mortgage interest Insurance Utilities Depreciation (a.) Determine Sam's deductible expenses using the IRS approach. (b.) How much depreciation can be deducted in the current year if the rental income was $12,000? (c.) Does Sam have any options with regard to the interest and taxes?

In the current year, Sam Lett purchased a condominium in Hilton Head Island, South Carolina. Sam and his family used the condominium for a total of 30 days. The condominium was rented out a total of 70 days during the year, generating $9,000 of rental income. Sam incurred the following expenses: (a.) Determine Sam's deductible expenses using the IRS approach. (b.) How much depreciation can be deducted in the current year if the rental income was $12,000 ? (c.) Does Sam have any options with regard to the interest and taxes

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock