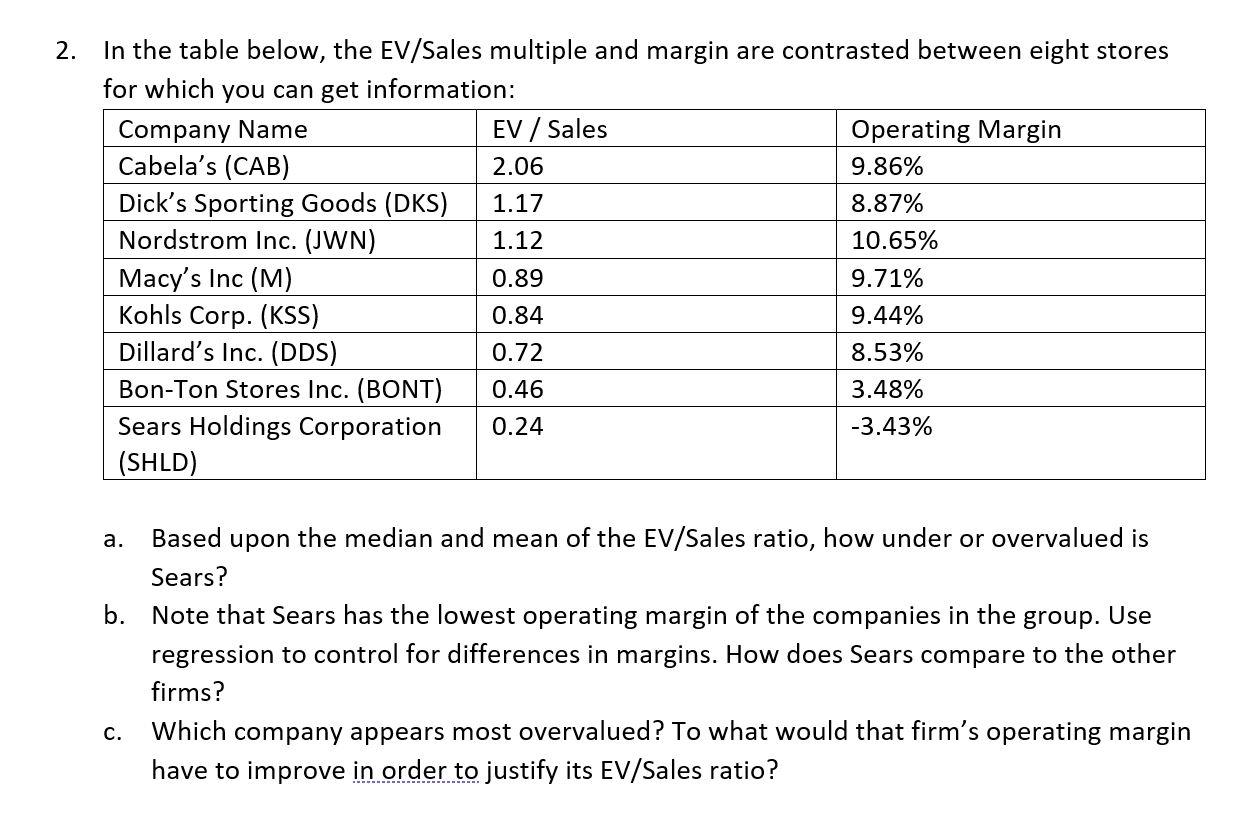

Question: 2. In the table below, the EV/Sales multiple and margin are contrasted between eight stores for which you can get information: Company Name EV /

2. In the table below, the EV/Sales multiple and margin are contrasted between eight stores for which you can get information: Company Name EV / Sales Operating Margin Cabela's (CAB) 2.06 9.86% Dick's Sporting Goods (DKS) 1.17 8.87% Nordstrom Inc. (JWN) 1.12 10.65% Macy's Inc (M) 0.89 9.71% Kohls Corp. (KSS) 0.84 9.44% Dillard's Inc. (DDS) 0.72 8.53% Bon-Ton Stores Inc. (BONT) 0.46 3.48% Sears Holdings Corporation 0.24 -3.43% (SHLD) a. Based upon the median and mean of the EV/Sales ratio, how under or overvalued is Sears? b. Note that Sears has the lowest operating margin of the companies in the group. Use regression to control for differences in margins. How does Sears compare to the other firms? Which company appears most overvalued? To what would that firm's operating margin have to improve in order to justify its EV/Sales ratio? C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts