Question: 2. It is now date zero. Currently the yield on a one-year bond is 10%, on a two-year bond is 15%, and on a

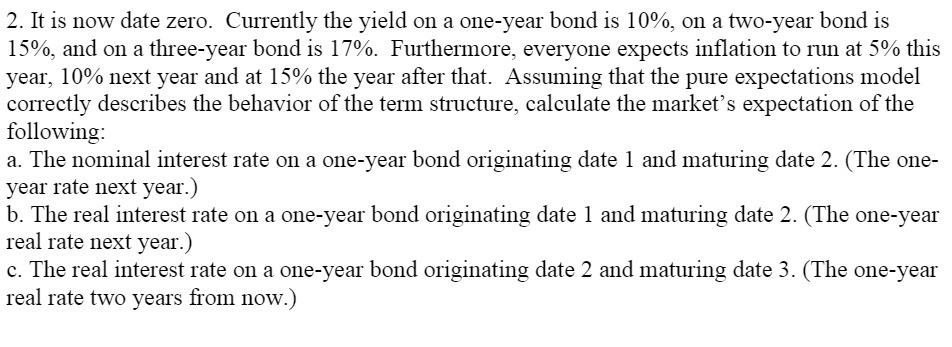

2. It is now date zero. Currently the yield on a one-year bond is 10%, on a two-year bond is 15%, and on a three-year bond is 17%. Furthermore, everyone expects inflation to run at 5% this year, 10% next year and at 15% the year after that. Assuming that the pure expectations model correctly describes the behavior of the term structure, calculate the market's expectation of the following: a. The nominal interest rate on a one-year bond originating date 1 and maturing date 2. (The one- year rate next year.) b. The real interest rate on a one-year bond originating date 1 and maturing date 2. (The one-year real rate next year.) c. The real interest rate on a one-year bond originating date 2 and maturing date 3. (The one-year real rate two years from now.)

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

To calculate the markets expectation of nominal and real interest rates we need to adjust the yield ... View full answer

Get step-by-step solutions from verified subject matter experts