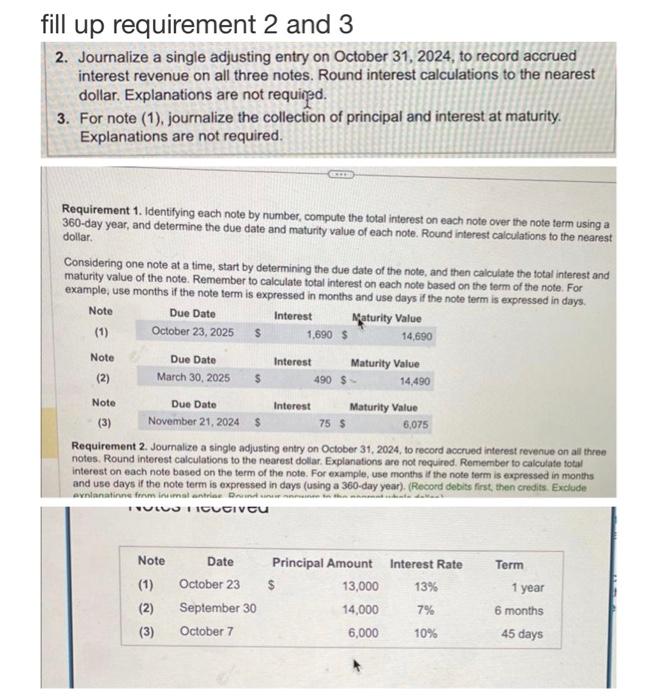

Question: 2. Journalize a single adjusting entry on October 31,2024 , to record accrued interest revenue on all three notes. Round interest calculations to the nearest

2. Journalize a single adjusting entry on October 31,2024 , to record accrued interest revenue on all three notes. Round interest calculations to the nearest dollar. Explanations are not requingd. 3. For note (1), journalize the collection of principal and interest at maturity. Explanations are not required. Requirement 1. Identifying each note by number, compute the total interest on each note over the note term using a 360-day year, and determine the due date and maturity value of each note. Round interest calculations to the nearest dollar. Considering one note at a time, start by determining the due date of the note, and then calculate the total interest and maturity value of the note. Remember to calculate total interest on each note based on the term of the note. For example, use months if the note term is expressed in months and use days if the note term is expressed in days. Requirement 2. Journalze a single adjusting entry on October 31, 2024, to record accrued interest revenue on all three notes. Round interest calculations to the nearest dollar. Explanations are not required. Remember to calculate total interest on each note based on the term of the note. For example, use months it the note term is expressed in montis and use days if the note term is expressed in days (using a 360 -day year). (Record debits first then crodits. Exclude)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts