Question: 2. Let T = 2,2 = {wi,..., wa}, P({wi}) > O for i = 1,...,4, Fo = {0,2}, F1 = {{wi, w2}, {w3, wa), 0,12},

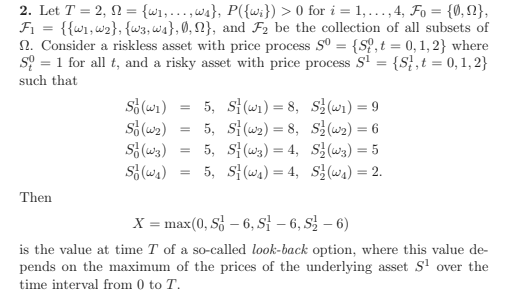

2. Let T = 2,2 = {wi,..., wa}, P({wi}) > O for i = 1,...,4, Fo = {0,2}, F1 = {{wi, w2}, {w3, wa), 0,12}, and F2 be the collection of all subsets of 12. Consider a riskless asset with price process s = {S,t=0,1,2} where S = 1 for all t, and a risky asset with price process Sl = {S,t = 0,1,2} such that S(wi) = 5, Si(wi) = 8, S}(wi) = 9 s(w) = 5, S (W2) = 8, S(w2) = 6 S.(w) = 5, S(w3) = 4, S}(W3) = 5 S. (wa) = 5, S(wa) = 4, S}(wa) = 2. Then X = max(0, S-6, -6, -6) is the value at time T of a so-called look back option, where this value de- pends on the maximum of the prices of the underlying asset sl over the time interval from 0 to T. (a) Explain why this model is viable and complete. (b) Find the no-arbitrage price for the European put option X = (5-). (c) Consider the random variable Y = ($112 (the square of the stock price at time t=2). Compute E*Y|Fi) and E*[Y|Fo]. 2. Let T = 2,2 = {wi,..., wa}, P({wi}) > O for i = 1,...,4, Fo = {0,2}, F1 = {{wi, w2}, {w3, wa), 0,12}, and F2 be the collection of all subsets of 12. Consider a riskless asset with price process s = {S,t=0,1,2} where S = 1 for all t, and a risky asset with price process Sl = {S,t = 0,1,2} such that S(wi) = 5, Si(wi) = 8, S}(wi) = 9 s(w) = 5, S (W2) = 8, S(w2) = 6 S.(w) = 5, S(w3) = 4, S}(W3) = 5 S. (wa) = 5, S(wa) = 4, S}(wa) = 2. Then X = max(0, S-6, -6, -6) is the value at time T of a so-called look back option, where this value de- pends on the maximum of the prices of the underlying asset sl over the time interval from 0 to T. (a) Explain why this model is viable and complete. (b) Find the no-arbitrage price for the European put option X = (5-). (c) Consider the random variable Y = ($112 (the square of the stock price at time t=2). Compute E*Y|Fi) and E*[Y|Fo]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts