Question: 2. More on the AFN (Additional Funds Needed) equation Fuzzy Button Clothing Company reported sales of $743,000 at the end of last year, but this

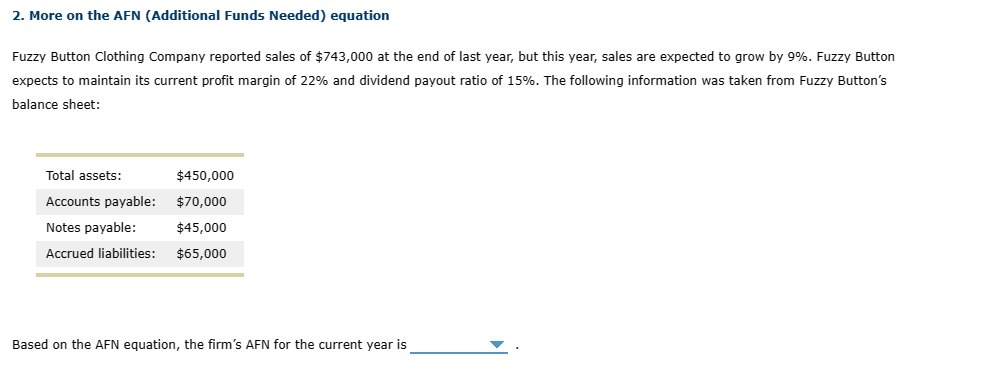

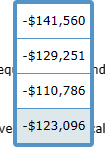

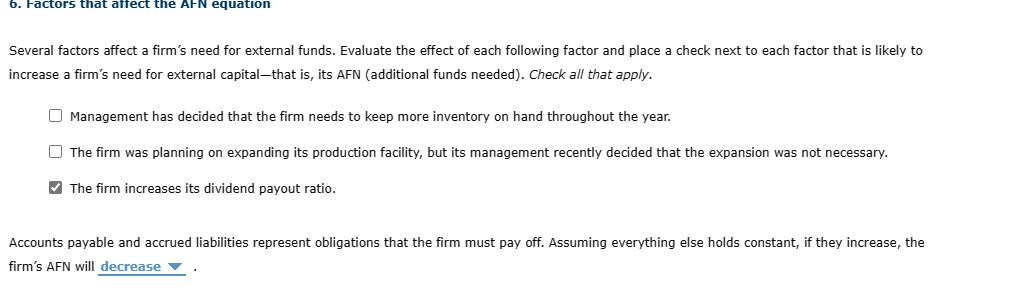

2. More on the AFN (Additional Funds Needed) equation Fuzzy Button Clothing Company reported sales of $743,000 at the end of last year, but this year, sales are expected to grow by 9%. Fuzzy Button expects to maintain its current profit margin of 22% and dividend payout ratio of 15%. The following information was taken from Fuzzy Button's balance sheet: Based on the AFN equation, the firm's AFN for the current year is \begin{tabular}{|} $141,560 \\ \hline$129,251 \\ \hline$110,786 \\ \hline ve $123,096 \end{tabular} Because of its excess funds, Fuzzy Button Clothing Company is thinking about raising its dividend payout ratio to satisfy shareholders. Fuzzy Button could pay out of its earnings to shareholders without needing to raise any external capital.(Hint: What can Fuzzy Button increase its dividend payout ratio to before the AFN becomes positive?) \begin{tabular}{|} \hline 67.3% \\ \hline 84.1% \\ \hline 75.7% \\ \hline 79.9% \end{tabular} Several factors affect a firm's need for external funds. Evaluate the effect of each following factor and place a check next to each factor that is likely to increase a firm's need for external capital-that is, its AFN (additional funds needed). Check all that apply. Management has decided that the firm needs to keep more inventory on hand throughout the year. The firm was planning on expanding its production facility, but its management recently decided that the expansion was not necessary. The firm increases its dividend payout ratio. Accounts payable and accrued liabilities represent obligations that the firm must pay off. Assuming everything else holds constant, if they increase, the firm's AFN will

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts