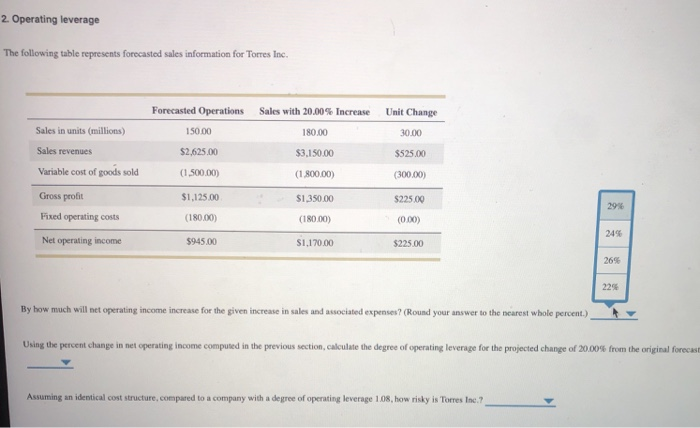

Question: 2 Operating leverage The following table represents forecasted sales information for Torres Inc Sales in units (millions) Sales revenues Variable cost of goods sold Gross

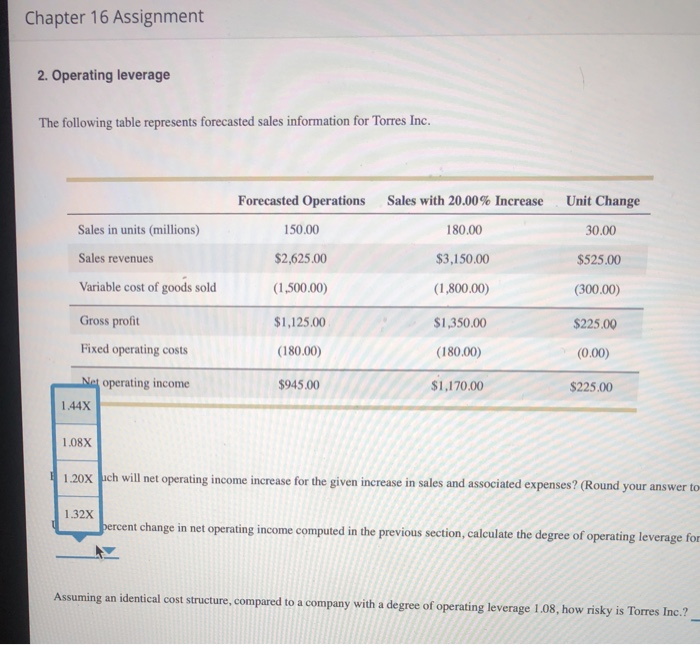

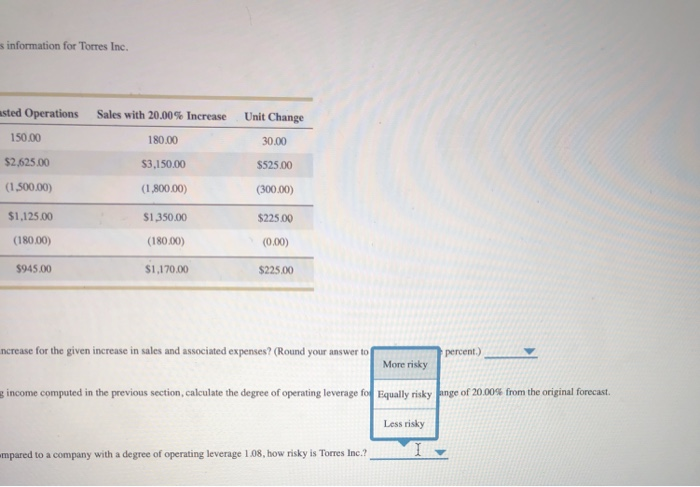

2 Operating leverage The following table represents forecasted sales information for Torres Inc Sales in units (millions) Sales revenues Variable cost of goods sold Gross profit Fixed operating costs Net operating income Forecasted Operations 150.00 $2,625.00 1500.00) $1,125.00 (180.00) $945.00 Sales with 20.00% Increase 180.00 $3,150.00 1 800.00) $1,35000 (180.00) $1,170.00 Unit Change 30.00 $525.00 (300.00) $225.00 (000) $225.00 29% 24% 26% 22% By how much will net operating income increase for the given increase in sales and associated expenses? (Round your answer to the nearest whole percent.)Y Using the percent change in net operating income com used in the previous section, calculate the degree of operating leverage for the projected change of2000 % the ongi al recas Assuming an identical cost structure, compared to a company with a degree of operating leverage 108, how risky is Torres Inc.7 Chapter 16 Assignment 2. Operating leverage The following table represents forecasted sales information for Torres Inc. Sales in units (millions) Sales revenues Variable cost of goods sold Gross profit Fixed operating costs Net operating income Forecasted Operations 150.00 $2,625.00 (1,500.00) $1,125.00 (180.00) $945.00 Sales with 20.00% Increase 180.00 $3,150.00 (1,800.00) 1,350.00 (180.00) $1,170.00 Unit Change 30.00 $525.00 (300.00) $225.00 (0.00) 225.00 144X 1.08X .20x uch will net operating income increase for the given increase in sales and associated expenses? (Round your answer to 1.32X percent change in net operating income computed in the previous section, calculate the degree of operating leverage for Assuming an identical cost structure, compared to a company with a degree of operating leverage 1,08, how risky is Torres Inc.? s information for Torres Inc. sted Operations Sales with 20.00% Increase 180.00 S3,150.00 (1,800.00) $1 35000 (180 00) $1,170.00 Unit Change 30.00 $525.00 (300.00) $225.00 (0.00) $225.00 150.00 $2,625.00 (1500.00) $1,125.00 (180.00) $945.00 .) ncrease for the given increase in sales and associated expenses? (Round your answer topercent) Y More risky Equally risky Less risky g income computed in the previous section, calculate the degree of operating leverage fo nge of 2000% from the original forecast. mpared to a company with a degree of operating leverage 1.08, how risky is Torres Inc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts