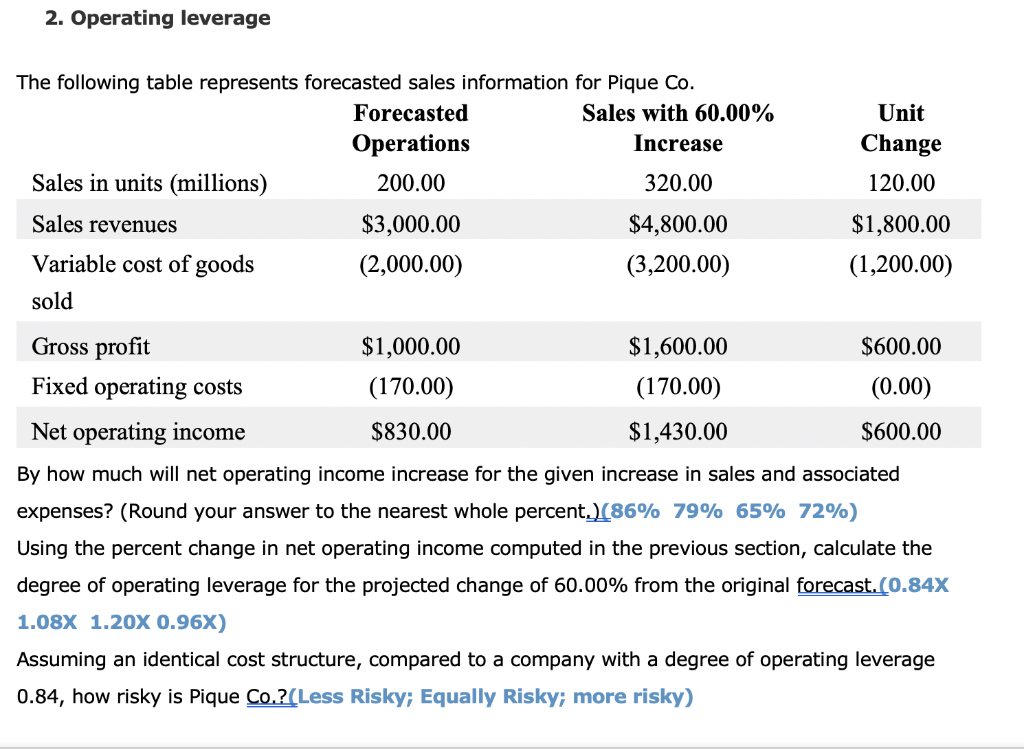

Question: 2. Operating leverage The following table represents forecasted sales information for Pique Co. Forecasted Sales with 60.00% Operations Increase Sales in units (millions) 200.00 320.00

2. Operating leverage The following table represents forecasted sales information for Pique Co. Forecasted Sales with 60.00% Operations Increase Sales in units (millions) 200.00 320.00 Sales revenues $3,000.00 $4,800.00 Variable cost of goods (2,000.00) (3,200.00) sold Unit Change 120.00 $1,800.00 (1,200.00) Gross profit $1,000.00 $1,600.00 $600.00 Fixed operating costs (170.00) (170.00) (0.00) Net operating income $830.00 $1,430.00 $600.00 By how much will net operating income increase for the given increase in sales and associated expenses? (Round your answer to the nearest whole percent. 186% 79% 65% 72%) Using the percent change in net operating income computed in the previous section, calculate the degree of operating leverage for the projected change of 60.00% from the original forecast. (0.84X 1.08X 1.20x 0.96X) Assuming an identical cost structure, compared to a company with a degree of operating leverage 0.84, how risky is Pique Co.?(Less Risky; Equally Risky; more risky)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts