Question: 2. Please also share how you solved it Case 2 (time value of money, 2.00 points) Suppose your current annual net salary is 12 000

2. Please also share how you solved it

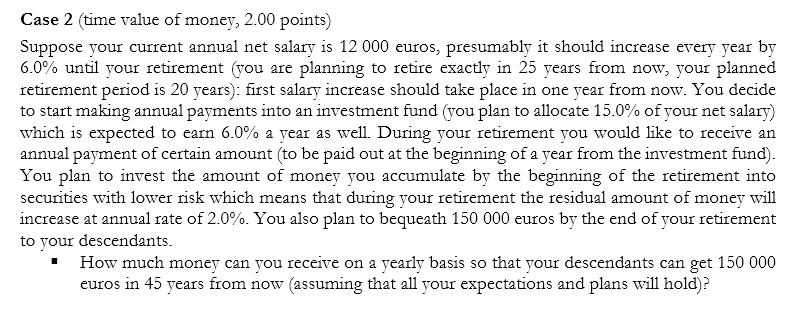

Case 2 (time value of money, 2.00 points) Suppose your current annual net salary is 12 000 euros, presumably it should increase every year by 6.0% until your retirement (you are planning to retire exactly in 25 years from now, your planned retirement period is 20 years): first salary increase should take place in one year from now. You decide to start making annual payments into an investment fund (you plan to allocate 15.0% of your net salary) which is expected to earn 6.0% a year as well. During your retirement you would like to receive an annual payment of certain amount (to be paid out at the beginning of a year from the investment fund). You plan to invest the amount of money you accumulate by the beginning of the retirement into securities with lower risk which means that during your retirement the residual amount of money will increase at annual rate of 2.0%. You also plan to bequeath 150 000 euros by the end of your retirement to your descendants. How much money can you receive on a yearly basis so that your descendants can get 150 000 euros in 45 years from now (assuming that all your expectations and plans will hold)? Case 2 (time value of money, 2.00 points) Suppose your current annual net salary is 12 000 euros, presumably it should increase every year by 6.0% until your retirement (you are planning to retire exactly in 25 years from now, your planned retirement period is 20 years): first salary increase should take place in one year from now. You decide to start making annual payments into an investment fund (you plan to allocate 15.0% of your net salary) which is expected to earn 6.0% a year as well. During your retirement you would like to receive an annual payment of certain amount (to be paid out at the beginning of a year from the investment fund). You plan to invest the amount of money you accumulate by the beginning of the retirement into securities with lower risk which means that during your retirement the residual amount of money will increase at annual rate of 2.0%. You also plan to bequeath 150 000 euros by the end of your retirement to your descendants. How much money can you receive on a yearly basis so that your descendants can get 150 000 euros in 45 years from now (assuming that all your expectations and plans will hold)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts