Question: Please include the formulas that you used and not just the answer, thank you! 4) You decide to borrow $500,000.00 for 339 days on a

Please include the formulas that you used and not just the answer, thank you!

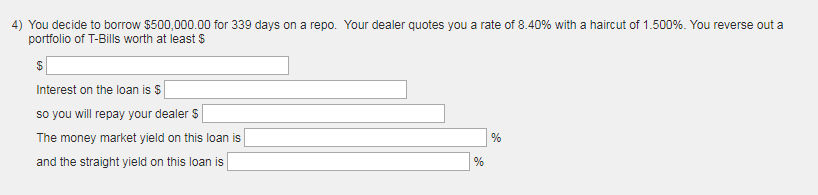

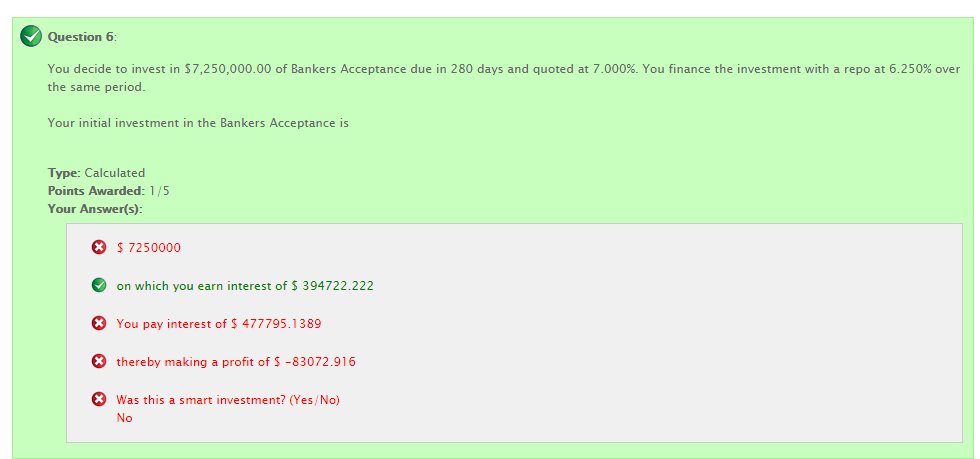

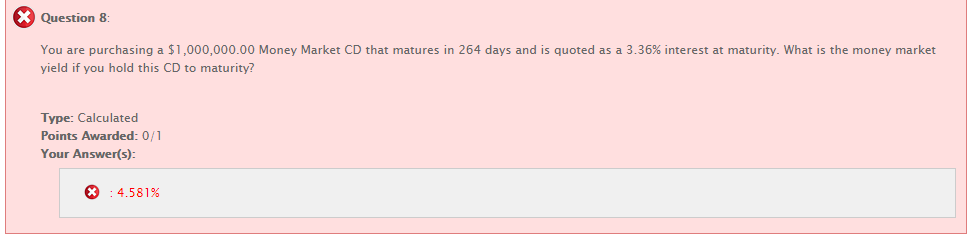

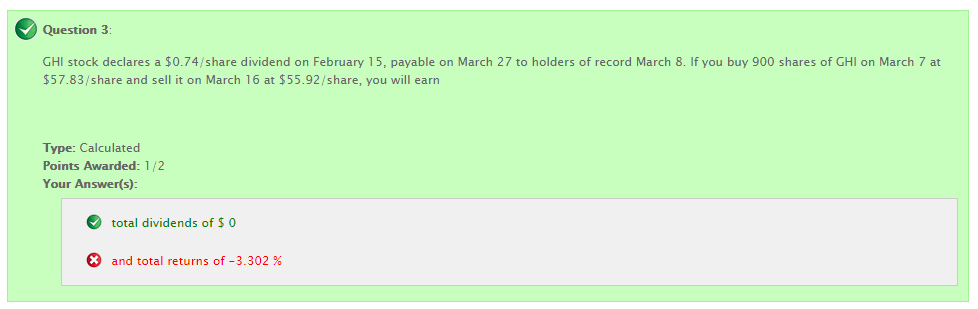

4) You decide to borrow $500,000.00 for 339 days on a repo. Your dealer quotes you a rate of 8.40% with a haircut of 1.500%. You reverse out a portfolio of T-Bills worth at least $ Interest on the loan is $ so you will repay your dealer $ The money market yield on this loan is and the straight yield on this loan is Question 6 You decide to invest in $7,250,000.00 of Bankers Acceptance due in 280 days and quoted at 7.000%. You finance the investment with a repo at 6.250% over the same period. Your initial investment in the Bankers Acceptance is Type: Calculated Points Awarded: 1/5 Your Answer(s): $ $ 7250000 on which you earn interest of $ 394722.222 * You pay interest of $ 477795.1389 * thereby making a profit of $ -83072.916 * Was this a smart investment? (Yes/No) No x Question 8 You are purchasing a $1,000,000.00 Money Market CD that matures in 264 days and is quoted as a 3.36% interest at maturity. What is the money market yield if you hold this CD to maturity? Type: Calculated Points Awarded: 0/1 Your Answer(s): X : 4.581% Question 3 : GHI stock declares a $0.74/share dividend on February 15, payable on March 27 to holders of record March 8. If you buy 900 shares of GHI on March 7 at $57.83/share and sell it on March 16 at $55.92/share, you will earn Type: Calculated Points Awarded: 1/2 Your Answer(s): total dividends of $ 0 X and total returns of -3.302 % 4) You decide to borrow $500,000.00 for 339 days on a repo. Your dealer quotes you a rate of 8.40% with a haircut of 1.500%. You reverse out a portfolio of T-Bills worth at least $ Interest on the loan is $ so you will repay your dealer $ The money market yield on this loan is and the straight yield on this loan is Question 6 You decide to invest in $7,250,000.00 of Bankers Acceptance due in 280 days and quoted at 7.000%. You finance the investment with a repo at 6.250% over the same period. Your initial investment in the Bankers Acceptance is Type: Calculated Points Awarded: 1/5 Your Answer(s): $ $ 7250000 on which you earn interest of $ 394722.222 * You pay interest of $ 477795.1389 * thereby making a profit of $ -83072.916 * Was this a smart investment? (Yes/No) No x Question 8 You are purchasing a $1,000,000.00 Money Market CD that matures in 264 days and is quoted as a 3.36% interest at maturity. What is the money market yield if you hold this CD to maturity? Type: Calculated Points Awarded: 0/1 Your Answer(s): X : 4.581% Question 3 : GHI stock declares a $0.74/share dividend on February 15, payable on March 27 to holders of record March 8. If you buy 900 shares of GHI on March 7 at $57.83/share and sell it on March 16 at $55.92/share, you will earn Type: Calculated Points Awarded: 1/2 Your Answer(s): total dividends of $ 0 X and total returns of -3.302 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts