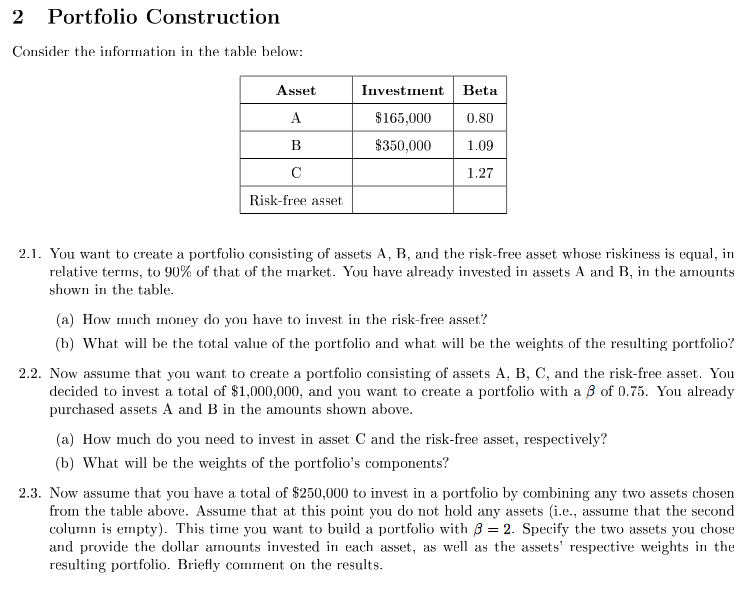

Question: 2 Portfolio Construction Consider the information in the table below: Asset Investment Beta $165,000 0.80 $350,000 1.09 B 1.27 Risk-free asset 2.1. You want to

2 Portfolio Construction Consider the information in the table below: Asset Investment Beta $165,000 0.80 $350,000 1.09 B 1.27 Risk-free asset 2.1. You want to create a portfolio consisting of assets A, B, and the risk-free asset whose riskiness is equal, in relative terms, to 90% of that of the market. You have already invested in assets A and B, in the amounts shown in the table. (a) How much money do you have to invest in the risk-free asset? (b) What will be the total value of the portfolio and what will be the weights of the resulting portfolio? 2.2. Now assume that you want to create a portfolio consisting of assets A, B, C, and the risk-free asset. You decided to invest a total of $1,000,000, and you want to create a portfolio with a B of 0.75. You already purchased assets A and B in the amounts shown above. (a) How much do you need to invest in asset C and the risk-free asset, respectively? (b) What will be the weights of the portfolio's components? 2.3. Now assume that you have a total of $250,000 to invest in a portfolio by combining any two assets chosen from the table above. Assume that at this point you do not hold any assets (i.e., assume that the second column is empty). This time you want to build a portfolio with B = 2. Specify the two assets you chose and provide the dollar amounts invested in each asset, as well as the assets' respective weights in the resulting portfolio. Briefly comment on the results

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts