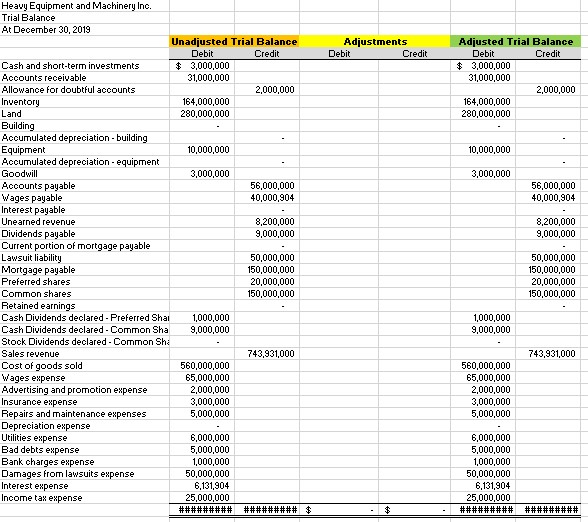

Question: 2. Post the adjusting journal entries that you have identified in Step #1 to the Excel trial balance spreadsheet in 2.0 Trial Balance and Statement

2. Post the adjusting journal entries that you have identified in Step #1 to the Excel trial balance spreadsheet in 2.0 Trial Balance and Statement of Income.

Adjustments Debit Credit Adjusted Trial Balance Debit Credit $ 3,000,000 31,000,000 2,000,000 164,000,000 280,000,000 10,000,000 3,000,000 56,000,000 40,000,904 8,200,000 9,000,000 Heavy Equipment and Machinery Inc. Trial Balance At December 30, 2019 Unadjusted Trial Balance Debit Credit Cash and short-term investments $ 3,000,000 Accounts receivable 31,000,000 Allowance for doubtful accounts 2,000,000 Inventory 164,000,000 Land 280,000,000 Building Accumulated depreciation - building Equipment 10,000,000 Accumulated depreciation equipment Goodwill 3,000,000 Accounts payable 56,000,000 Wages payable 40,000,904 Interest payable Unearned revenue 8,200,000 Dividends payable 9,000,000 Current portion of mortgage payable Lawsuit liability 50,000,000 Mortgage payable 150,000,000 Preferred shares 20,000,000 Common shares 150,000,000 Retained earnings Cash Dividends declared - Preferred Shal 1,000,000 Cash Dividends declared - Common Sha 9,000,000 Stock Dividends declared - Common Sha Sales revenue 743,931,000 Cost of goods sold 560,000,000 Wages expense 65,000,000 Advertising and promotion expense 2,000,000 Insurance expense 3,000,000 Repairs and maintenance expenses 5,000,000 Depreciation expense Utilities expense 6,000,000 Bad debts expense 5,000,000 Bank charges expense 1,000,000 Damages from lawsuits expense 50,000,000 Interest expense 6,131,904 Income tax expense 25,000,000 ######### ######### $ 50,000,000 150,000,000 20,000,000 150,000,000 1,000,000 9,000,000 743,931,000 560,000,000 65,000,000 2,000,000 3,000,000 5,000,000 6,000,000 5,000,000 1,000,000 50,000,000 6,131,904 25,000,000 ######### $ ######### Adjustments Debit Credit Adjusted Trial Balance Debit Credit $ 3,000,000 31,000,000 2,000,000 164,000,000 280,000,000 10,000,000 3,000,000 56,000,000 40,000,904 8,200,000 9,000,000 Heavy Equipment and Machinery Inc. Trial Balance At December 30, 2019 Unadjusted Trial Balance Debit Credit Cash and short-term investments $ 3,000,000 Accounts receivable 31,000,000 Allowance for doubtful accounts 2,000,000 Inventory 164,000,000 Land 280,000,000 Building Accumulated depreciation - building Equipment 10,000,000 Accumulated depreciation equipment Goodwill 3,000,000 Accounts payable 56,000,000 Wages payable 40,000,904 Interest payable Unearned revenue 8,200,000 Dividends payable 9,000,000 Current portion of mortgage payable Lawsuit liability 50,000,000 Mortgage payable 150,000,000 Preferred shares 20,000,000 Common shares 150,000,000 Retained earnings Cash Dividends declared - Preferred Shal 1,000,000 Cash Dividends declared - Common Sha 9,000,000 Stock Dividends declared - Common Sha Sales revenue 743,931,000 Cost of goods sold 560,000,000 Wages expense 65,000,000 Advertising and promotion expense 2,000,000 Insurance expense 3,000,000 Repairs and maintenance expenses 5,000,000 Depreciation expense Utilities expense 6,000,000 Bad debts expense 5,000,000 Bank charges expense 1,000,000 Damages from lawsuits expense 50,000,000 Interest expense 6,131,904 Income tax expense 25,000,000 ######### ######### $ 50,000,000 150,000,000 20,000,000 150,000,000 1,000,000 9,000,000 743,931,000 560,000,000 65,000,000 2,000,000 3,000,000 5,000,000 6,000,000 5,000,000 1,000,000 50,000,000 6,131,904 25,000,000 ######### $ #########

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts