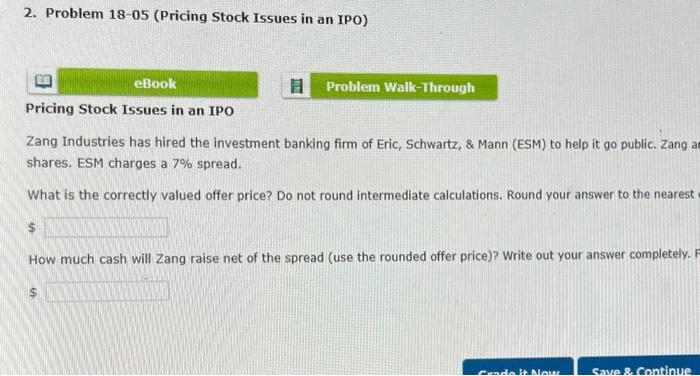

Question: 2. Problem 18-05 (Pricing Stock Issues in an IPO) Pricing Stock Issues in an IPO Zang Industries has hired the investment banking firm of Eric,

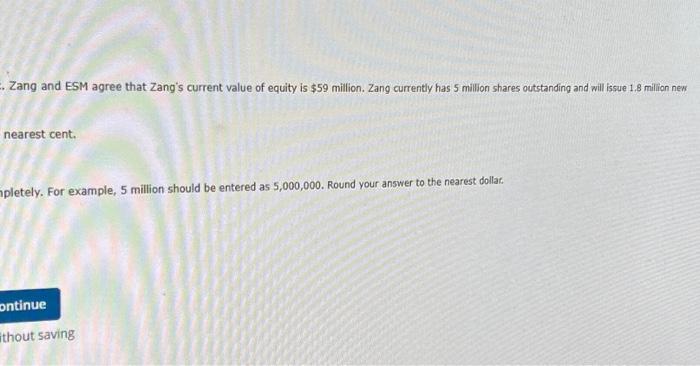

2. Problem 18-05 (Pricing Stock Issues in an IPO) Pricing Stock Issues in an IPO Zang Industries has hired the investment banking firm of Eric, schwartz, \& Mann (ESM) to help it go public. Zang shares. ESM charges a 7% spread. What is the correctly valued offer price? Do not round intermediate calculations. Round your answer to the nearest How much cash will Zang raise net of the spread (use the rounded offer price)? Write out your answer completely. $ nearest cent. ipletely. For example, 5 million should be entered as 5,000,000. Round your answer to the nearest dollat. Vricline Steck Ivwes in an 190 shares. Elat charpet a 75 seread

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts