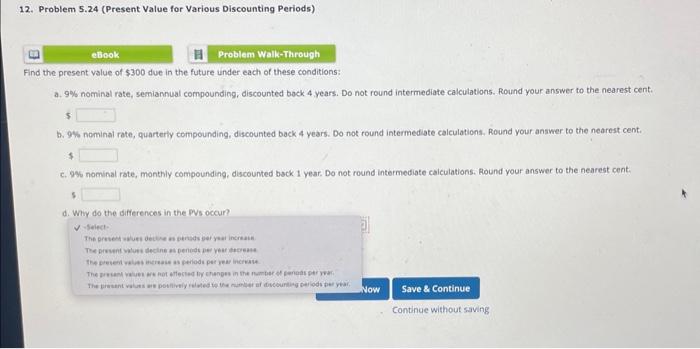

Question: 2. Problem 5.24 (Present Value for Various Discounting Periods) Find the present value of $300 due in the future under each of these conditions: a.

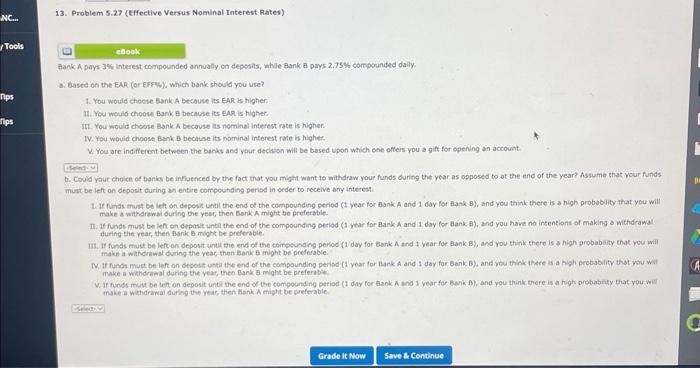

2. Problem 5.24 (Present Value for Various Discounting Periods) Find the present value of $300 due in the future under each of these conditions: a. 9% nominal rate, semiannual compounding, discounted bock 4 years. Do not round intermediate calculations. Round your answer to the nearest cent. 5 b. 9% nominal rate, quarterly compounding, discounted back 4 years. Do not round intermediate calculations, Round your answer to the nearest cent. 5 c. 9Yi nominal rate, monthly compounding, discounted back 1 year. Do not round intermediate calculations. Round your answer to the nearest cent. 5 d. Why do the differences in the PVs occur? -select- The ersted wutb detbe os perses get year increath Tee prevent whuss decine as penedt per vear taeseme the dreted revet uerease as periods per year incruine 13. Problem 5.27 (Effective Versus Nominal Interest Rates) Aank A pays 3\% interest coripounded annually on deposits, whle Bank A pays 2.75\% compounded dally: W. Eastd on the EAR (or EFFHW), which bank should you vise? 1. You would cheose Bank A because its EAR is higher. II. You would choose Bank A because its EAR is higher: II. You would choose eank A becavse as nominal interest rate is highen. W. You would choose Bank B because its nominal interest rate is higher V. You are indifferent between the banks and your dechion will be based upoh which ene ofters you a gift for opening an actount. b. Csuld your choice of bariks be infiuenced by the fact that you might want to mithdraw your funds during the year as opposed to ot the end of the year? Assume that your funds must be let on deposit during an entire compounding period in order to receive ary interest. 1. If furas muit be let on depopt undil the end of the compounding period (1 year for gank A and 1 day for flank 8 ), and you thiok there is a high probobuty that you will make a witharawal during the yea, then bonk A might be preferable. II. It funds must be ief on dpposit until the end of the compounding period (1 year tor Bank A and 1 day for bank b), and you have no intentiont of making a withdrawal. during the year, then farik B might be preferabie. IiI. It funds must be left on deposit until the end of the coimpounding period (1 day for tark A and t year for lank B), and you think there is a high probablity that you will make a wathdrawat during the year, then benis 8 might be prederable. F. If funds must be left on degost unta the end of the compoundino penod ( 2 year for Bark A and 1 day far Bank B), and you think there is a high probsbility thet you wit make a withdranal during the year, then gank 8 might be preferabte v. if funds must be leh on deposit unti the end of the compounding peried ( 1 day for tank A and I vear for bank B), and you think there is a high probebity that you we make a w tharawal during the year, then benik A might be preferable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts