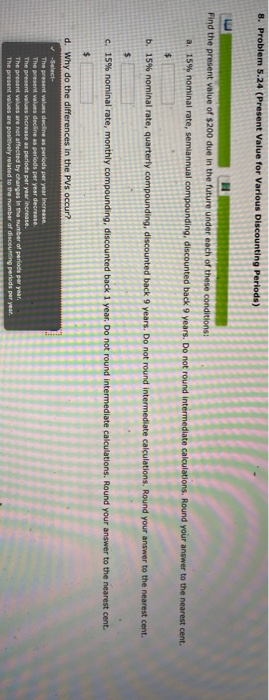

Question: 8. Problem 5.24 (Present Value for Various Discounting Periods) Find the present value of $200 due in the future under each of these conditions: a.

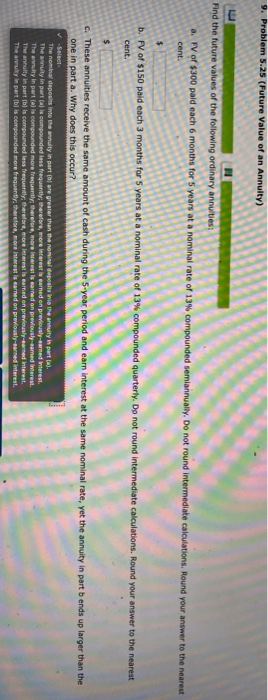

8. Problem 5.24 (Present Value for Various Discounting Periods) Find the present value of $200 due in the future under each of these conditions: a. 15% nominal rate, semiannual compounding, discounted back 9 years. Do not round Intermediate calculations. Round your answer to the nearest cent. $ b. 15% nominal rate, quarterly compounding, discounted back 9 years. Do not round intermediate calculations, Round your answer to the nearest cent. $ c. 15% nominal rate, monthly compounding, discounted back 1 year. Do not round Intermediate calculations. Round your answer to the nearest cent. $ d. Why do the differences in the PVs occur -Select- The present value decline as periods per year increase The present values decline as periods per year decrease The present values increase as perioda per year increase The present values are not affected by changes in the number of periods per year. The present values are positively related to the number of discounting periods per year. 9. Problem 5.25 (Future Value of an Annuity) Find the future values of the following ordinary annuities: a. IV of $300 paid each 6 months for 5 years at a nominal rate of 13% compounded semiannually. Do not round Intermediate calculations. Round your answer to the nearest cent. $ b. PV of $150 paid each 3 months for 5 years at a nominal rate of 13% compounded quarterly. Do not round intermediate calculations. Round your answer to the nearest cent. $ c. These annuities receive the same amount of cash during the 5-year period and earn interest at the same nominal rate, yet the annuity in part b ends up larger than the one in part a. Why does this occur? Select The nominal deposits into the annuity in part are greater than the nominal deposits in the annuity is part (8) The annuity in part a la compounded less frequently, therefore, more interest learned en previously earned interest The annuity in partis corpounded more frequently, therefore, more interest is earned on previously-came interest The annuity in part (bis compounded less frequently, therefore, more interest is eamed on previously earned interest The annuty in part (bls compounded more frequently, therefore, more interest is earned on previously and interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts