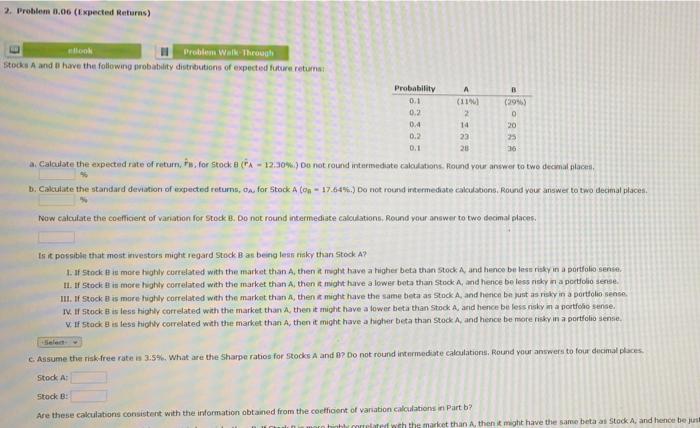

Question: 2. Problem 8.00 (Expected Returns) ook Problem Walk Through Stocks A and B have the following probability distributions of expected future retums Probability 0.1 0.2

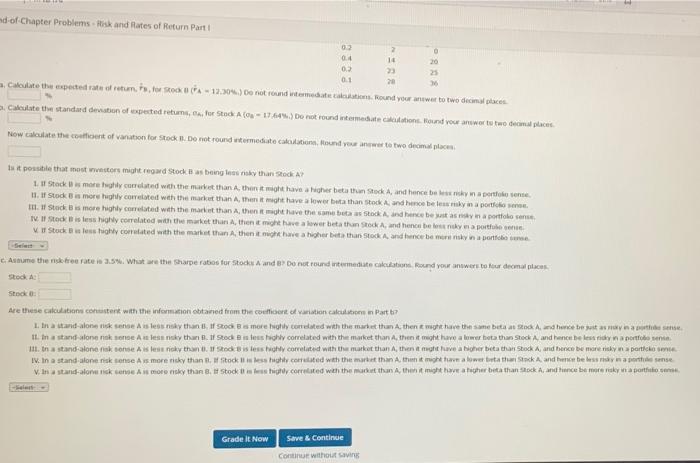

2. Problem 8.00 (Expected Returns) ook Problem Walk Through Stocks A and B have the following probability distributions of expected future retums Probability 0.1 0.2 0.4 0.2 0.1 A (114) 2 14 23 20 B (299) 0 20 25 a. Calculate the expected rate of return, Po. for Stocke (PA-12.306.) Do not round intermediate calculations. Round your answer to two decimal bloce, b. Calculate the standard deviation of expected returns, on for Stock A con- 17.646.) Do not round intermediate calculations, Round your answer to two decimal places now calculate the coefficient of variation for Stock B, Do not round intermediate calculations, Round your answer to two decimal places. Is it possible that most investors might regard Stock B as being less einky than Stock A? 1. of Stock is more hohly correlated with the market than A, then it mot have a higher beta than Stock A, and hence be less risky in a portfolio sense 11. If Stock is more highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be less sky in a portfolio sense III. of Stock is more highly correlated with the market than A, then it might have the same beta as Stock A, and hence be just as risky in a portfolio sense IV. If Stock is less highly correlated with the market than then it might have a lower beta than Stock A, and hence be less risky in a portfoo sense. W. If Stock is less highly correlated with the market than A, then it might have a higher beta than Stock A, and hence be more risky in a portfolio sense. c. Assume the risk free rate is 3.5%. What are the Sharpe ratios For Stocks A and ? Do not round intermediate calculations, Round your answers to four decimal places. Stock A Stock B Are these cakulations consistent with the information obtained from the coefficient of variation calculations in Part b? morate with the market than A, then it might have the same beta a Stock A, and hence be jus ad of Chapter Problemstisk and Rates of Return Part 2 B32 08 0.1 23 20 26 Cetate the expected rate of return, o, to su A-12.304) Do not found wtermediate cake. Round your answer to two decimal places Calculate the standard ton of pested retums, c. for Stud Atos - 1750.) Do not found intermediate cations. Round your newer to two decimal places How calculate the colours of variation for Stock 1. Do not round stermediate cakestation, Hond your newer to two dromal place Is it possible that most wivestors might regard stock as being noky than Stock A 1. Stock marelughly correlated with the market than then it might have a higher beatha Stod, and hence beyin a portione 1. Stock is more highly correlated with the market than then it might have a lower but than stock and hence bele makina porta Stock is more highly correlated with the market than then it might have the same buta as stock and hence best any en a portfolio IV. stock is less highly correlated with the market than A, then it might have a lower beta than stock, and has been in a portful Stock is less highly correlated with the market than then to have a higher beathan Stock and hence be mornisky na pre t. Anume themsk free rate in 2.5%. What are the shape ratios tur Stocku w and Do not round intermediate cacation Round your answers to four decal places Stod. A Stock Are these calculation content with the information obtained from the court of variation calculation Part 7 1. In a stand-alonek sense is less nay than och s more by correlated with the market than then there the same beta Stock A, and he beguit may napuntesse 11. In a standalone nakone A in lesensky than 0. Stock entschi correlated with the market than then it might have a lower botathan Stock A, and hence be less ridy na portato in in. In a stand-alone riksone A is less than stod is less only correlated with the market than then mahtuve a higher beta than Stock A, and bence be more in a partickom IV. In a standalone niske A is more niky than stock is less hughly conted with the market than then it halower tathStack, and hence bebesky na presente v In a stand-alone rick e morensky than 8. stocks as highly correlated with the market than then it might have a tigher beta than ock A, and hence be more viky na portfolio Grade it Now Save & Continue Continue without

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts