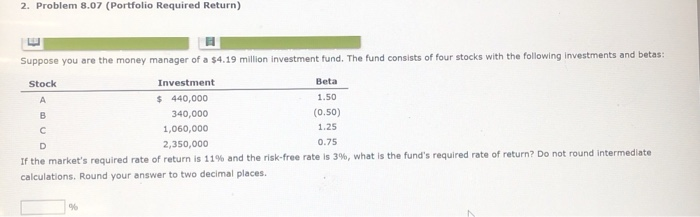

Question: 2. Problem 8.07 (Portfolio Required Return) Suppose you are the money manager of a $4.19 million investment fund. The fund consists of four stocks with

2. Problem 8.07 (Portfolio Required Return) Suppose you are the money manager of a $4.19 million investment fund. The fund consists of four stocks with the following investments and betas: Stock Investment Beta A $ 440,000 1.50 B 340,000 (0.50) 1,060,000 1.25 D 2,350,000 0.75 If the market's required rate of return is 11% and the risk-free rate is 3%, what is the fund's required rate of return? Do not round Intermediate calculations. Round your answer to two decimal places. 96

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts