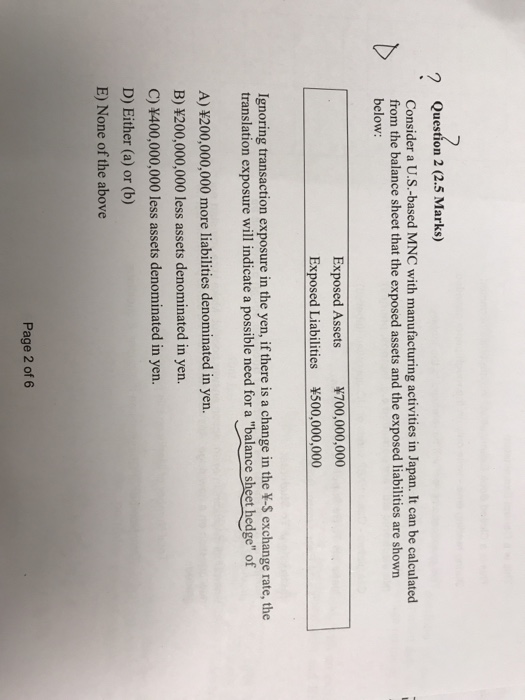

Question: 2 Question 2 (2.5 Marks) Consider a U.S.-based MNC with manufacturing activities in Japan. It can be calculated from the balance sheet that the exposed

2 Question 2 (2.5 Marks) Consider a U.S.-based MNC with manufacturing activities in Japan. It can be calculated from the balance sheet that the exposed assets and the exposed liabilities are shown below: Exposed Assets 700,000,000 Exposed Liabilities 500,000,000 Ignoring transaction exposure in the yen, if there is a change in the Y-S exchange rate, the translation exposure will indicate a possible need for a "balance sheet hedge" of A) 200,000,000 more liabilities denominated in yen. B) 200,000,000 less assets denominated in yen. C) 400,000,000 less assets denominated in yen. D) Either (a) or (b) E) None of the above Page 2 of 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts