Question: 2) Saturn Design Studio (SDS) considers purchasing a computer system, Solar II, with professional graphic design software and a high quality printer to expand its

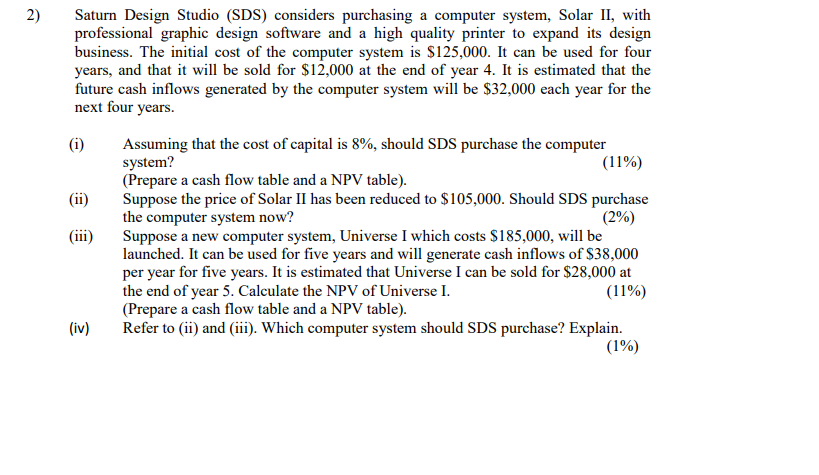

2) Saturn Design Studio (SDS) considers purchasing a computer system, Solar II, with professional graphic design software and a high quality printer to expand its design business. The initial cost of the computer system is $125,000. It can be used for four years, and that it will be sold for $12,000 at the end of year 4. It is estimated that the future cash inflows generated by the computer system will be $32,000 each year for the next four years. (i) Assuming that the cost of capital is 8%, should SDS purchase the computer system? (11%) (Prepare a cash flow table and a NPV table). Suppose the price of Solar II has been reduced to $105,000. Should SDS purchase the computer system now? (2%) (iii) Suppose a new computer system, Universe I which costs $185,000, will be launched. It can be used for five years and will generate cash inflows of $38,000 per year for five years. It is estimated that Universe I can be sold for $28,000 at the end of year 5. Calculate the NPV of Universe I. (11%) (Prepare a cash flow table and a NPV table). Refer to (ii) and (iii). Which computer system should SDS purchase? Explain. (1%) (iv)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts