Question: 2. (stochastic volatility, random interest rate) Consider a binomial pricing model, but at each time n1, the up factor un(1n), the down factor dn(1n), and

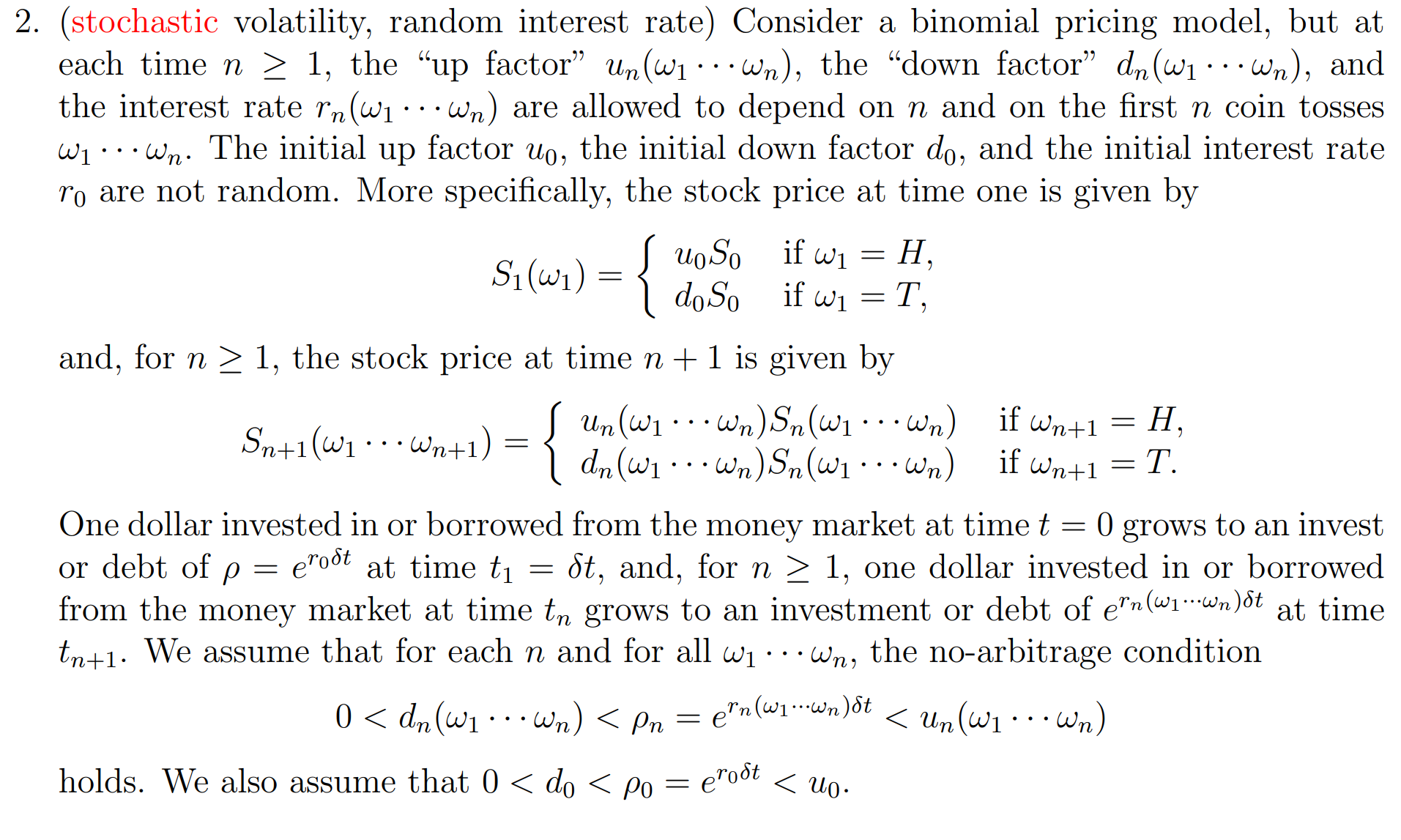

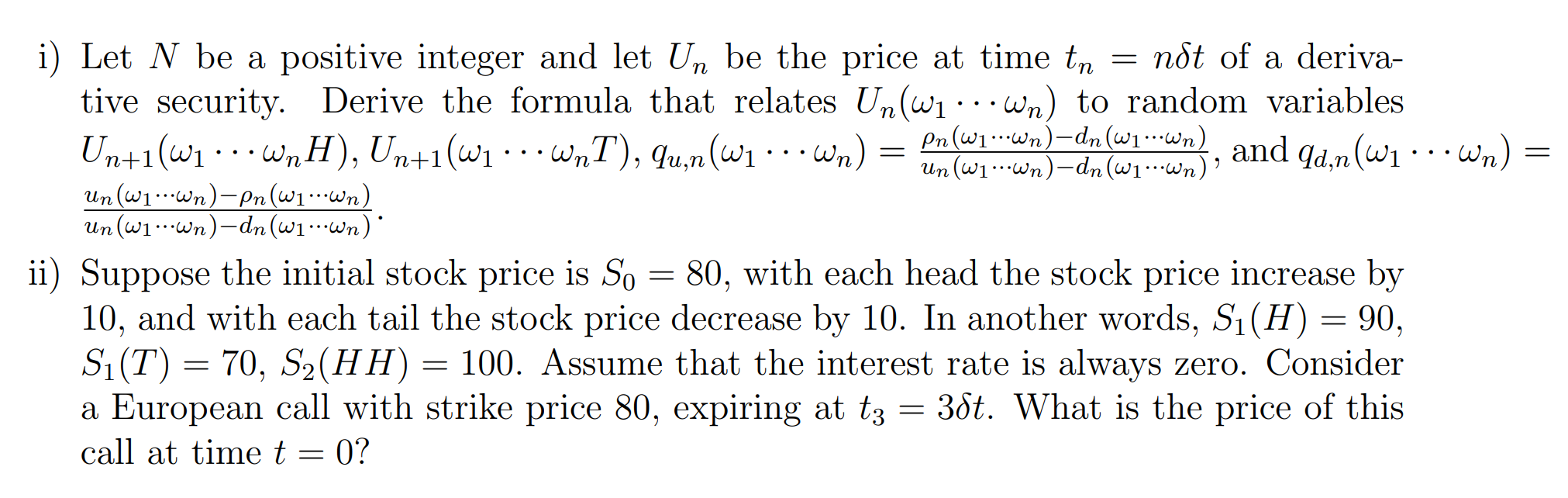

2. (stochastic volatility, random interest rate) Consider a binomial pricing model, but at each time n1, the "up factor" un(1n), the "down factor" dn(1n), and the interest rate rn(1n) are allowed to depend on n and on the first n coin tosses 1n. The initial up factor u0, the initial down factor d0, and the initial interest rate r0 are not random. More specifically, the stock price at time one is given by S1(1)={u0S0d0S0if1=H,if1=T, and, for n1, the stock price at time n+1 is given by Sn+1(1n+1)={un(1n)Sn(1n)dn(1n)Sn(1n)ifn+1=H,ifn+1=T. One dollar invested in or borrowed from the money market at time t=0 grows to an invest or debt of =er0t at time t1=t, and, for n1, one dollar invested in or borrowed from the money market at time tn grows to an investment or debt of ern(1n)t at time tn+1. We assume that for each n and for all 1n, the no-arbitrage condition 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts