Question: Consider a binomial pricing model, but at each time n 1, the up factor un (wwn), the down factor dn (wn), and the interest

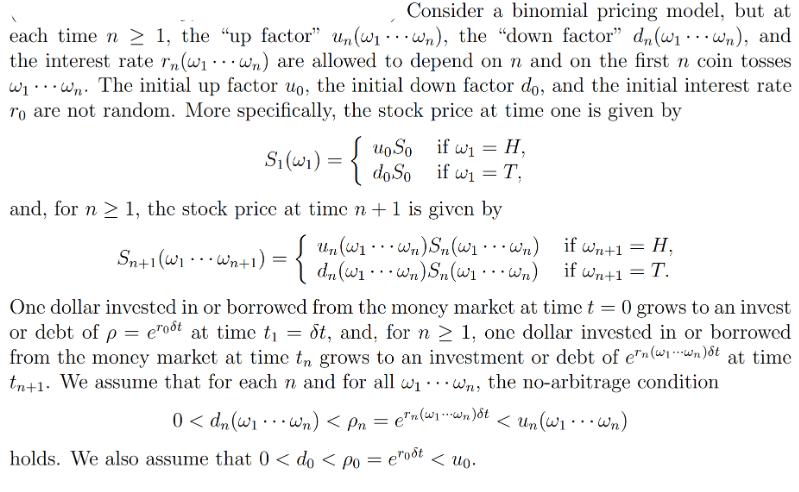

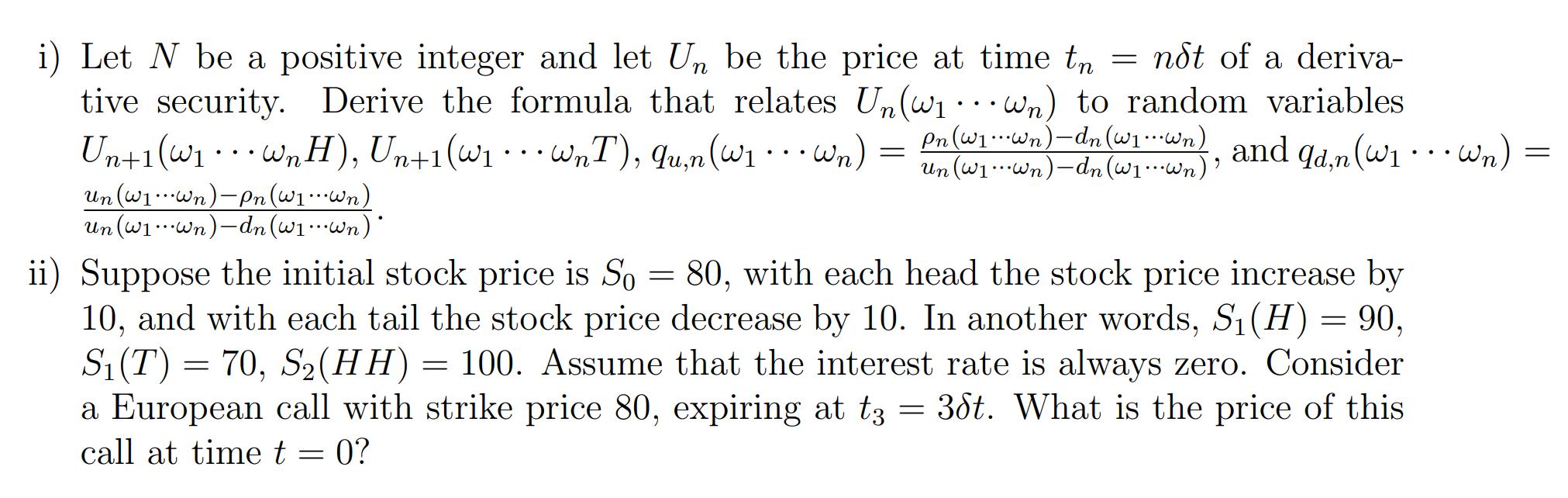

Consider a binomial pricing model, but at each time n 1, the "up factor" un (wwn), the "down factor" dn (wn), and the interest rate rn (Wwn) are allowed to depend on n and on the first n coin tosses Wwn. The initial up factor uo, the initial down factor do, and the initial interest rate To are not random. More specifically, the stock price at time one is given by uoSo S (w) = { do So and, for n 1, the stock price at time n + 1 is given by Sa+1(W) --- Wa+1) = { Un (W dn (W ... if w if w wn) Sn (W wn) Sn (W holds. We also assume that 0 < do < po = erost = H, T, = < uo. wn) wn) One dollar invested in or borrowed from the money market at time t = 0 grows to an invest or debt of p = erot at time t = dt, and, for n 1, one dollar invested in or borrowed from the money market at time tn grows to an investment or debt of en(n)t at time tn+1. We assume that for each n and for all wwn, the no-arbitrage condition if Wn+1 = H, if wn+1 = = T. 0 i) Let N be a positive integer and let Un be the price at time tn = not of a deriva- tive security. Derive the formula that relates Un(w Un+1(w Wn H), Un+1(w WnT), qun (W... wn) Un (W Wn) - Pn (W1... Wn) un (w1wn) -dn (w wn) * = wn) to random variables Pn (w1wn) -dn (w...wn) and qd,n (W... Wn) un (w1wn) -dn (w... wn) ' ii) Suppose the initial stock price is So= 80, with each head the stock price increase by 10, and with each tail the stock price decrease by 10. In another words, S (H) = 90, S (T) = 70, S(HH) = 100. Assume that the interest rate is always zero. Consider a European call with strike price 80, expiring at t3 = 36t. What is the price of this call at time t = 0? =

Step by Step Solution

3.30 Rating (156 Votes )

There are 3 Steps involved in it

To derive the formula that relates the price of the derivative security Un at time tn to the random ... View full answer

Get step-by-step solutions from verified subject matter experts