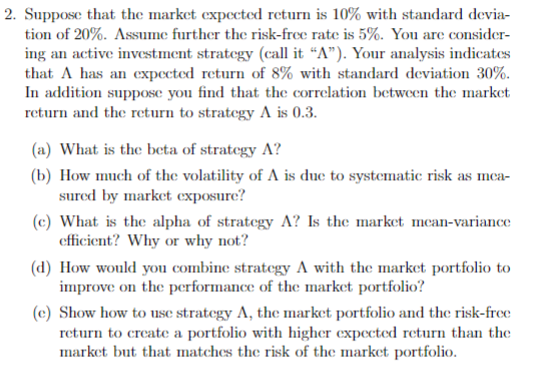

Question: 2. Suppose that the market expected return is 10% with standard deviation of 20%. Assume further the risk-free rate is 5%. You are considering an

2. Suppose that the market expected return is 10% with standard deviation of 20%. Assume further the risk-free rate is 5%. You are considering an active investment strategy (call it " "). Your analysis indicates that has an expected return of 8% with standard deviation 30%. In addition suppose you find that the correlation between the market return and the return to strategy is 0.3. (a) What is the beta of strategy ? (b) How much of the volatility of is due to systematic risk as measured by market exposure? (c) What is the alpha of strategy ? Is the market mean-variance efficient? Why or why not? (d) How would you combine strategy with the market portfolio to improve on the performance of the market portfolio? (c) Show how to use strategy , the market portfolio and the risk-free return to create a portfolio with higher expected return than the market but that matches the risk of the market portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts