Question: 2. Suppose that the term structure is currently flat so that bonds of all maturities have yields to maturity of 10%. Currently a 5-year

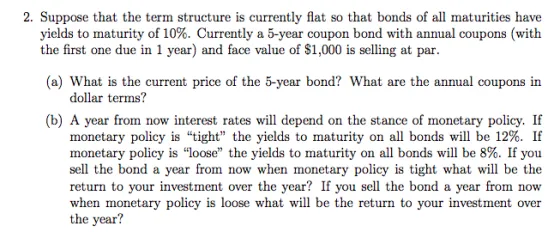

2. Suppose that the term structure is currently flat so that bonds of all maturities have yields to maturity of 10%. Currently a 5-year coupon bond with annual coupons (with the first one due in 1 year) and face value of $1,000 is selling at par. (a) What is the current price of the 5-year bond? What are the annual coupons in dollar terms? (b) A year from now interest rates will depend on the stance of monetary policy. If monetary policy is "tight" the yields to maturity on all bonds will be 12%. If monetary policy is "loose" the yields to maturity on all bonds will be 8%. If you sell the bond a year from now when monetary policy is tight what will be the return to your investment over the year? If you sell the bond a year from now when monetary policy is loose what will be the return to your investment over the year?

Step by Step Solution

3.27 Rating (147 Votes )

There are 3 Steps involved in it

Solution a Current Price and Annual Coupons Current price The bond is selling at par which means its ... View full answer

Get step-by-step solutions from verified subject matter experts