Question: 2. Suppose that you observe the monthly data given below for the spot prices of a certain commodity that you will be selling a month

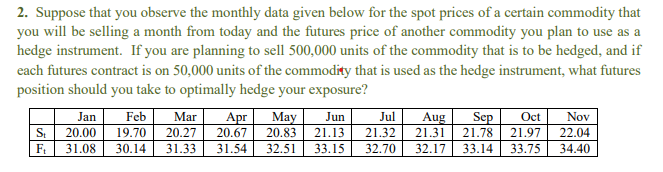

2. Suppose that you observe the monthly data given below for the spot prices of a certain commodity that you will be selling a month from today and the futures price of another commodity you plan to use as a hedge instrument. If you are planning to sell 500,000 units of the commodity that is to be hedged, and if each futures contract is on 50,000 units of the commodity that is used as the hedge instrument, what futures position should you take to optimally hedge your exposure? Mar Apr May Jul Aug Sep Nov 20.00 19.70 20.83 21.32 21.78 22.04 Ft 31.08 30.14 31.33 33.15 32.70 32.17 33.75 Jan Feb Jun 21.13 Oct 21.97 S 20.27 21.31 20.67 31.54 32.51 33.14 34.40 2. Suppose that you observe the monthly data given below for the spot prices of a certain commodity that you will be selling a month from today and the futures price of another commodity you plan to use as a hedge instrument. If you are planning to sell 500,000 units of the commodity that is to be hedged, and if each futures contract is on 50,000 units of the commodity that is used as the hedge instrument, what futures position should you take to optimally hedge your exposure? Mar Apr May Jul Aug Sep Nov 20.00 19.70 20.83 21.32 21.78 22.04 Ft 31.08 30.14 31.33 33.15 32.70 32.17 33.75 Jan Feb Jun 21.13 Oct 21.97 S 20.27 21.31 20.67 31.54 32.51 33.14 34.40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts