Question: 2. Table is given below shows that marginal tax rates for Alejandro Corporation. Taxable Income of the Company is equal to $44.000. How much will

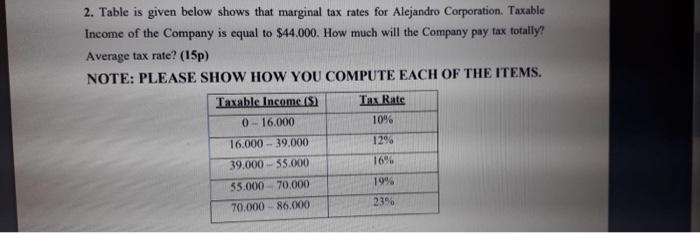

2. Table is given below shows that marginal tax rates for Alejandro Corporation. Taxable Income of the Company is equal to $44.000. How much will the Company pay tax totally? Average tax rate? (15p) NOTE: PLEASE SHOW HOW YOU COMPUTE EACH OF THE ITEMS. Taxable Income ($) Tax Rate 0-16.000 10% 12% 16% 19% 23% 16.000 39.000 39.000 55.000 55.000-70.000 70.000 86.000

2. Table is given below shows that marginal tax rates for Alejandro Corporation. Taxable Income of the Company is equal to $44,000. How much will the Company pay tax totally? Average tax rate? (15p) NOTE: PLEASE SHOW HOW YOU COMPUTE EACH OF THE ITEMS

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock