Question: 2. Table is given below shows that marginal tax rates for Alejandro Corporation. Taxable Income of the Company is equal to $44.000. How much will

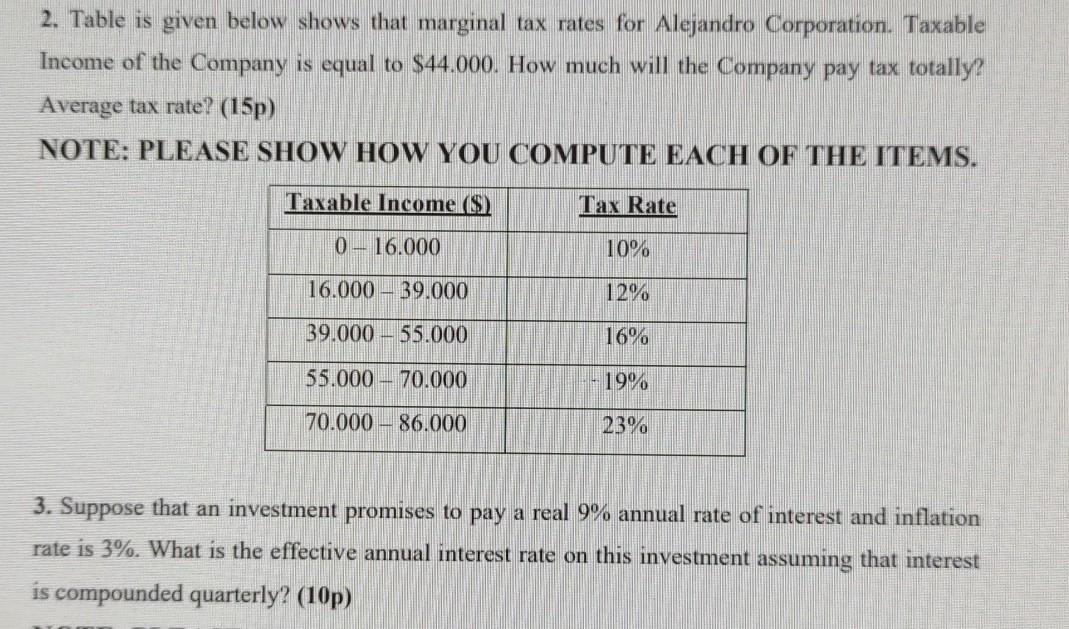

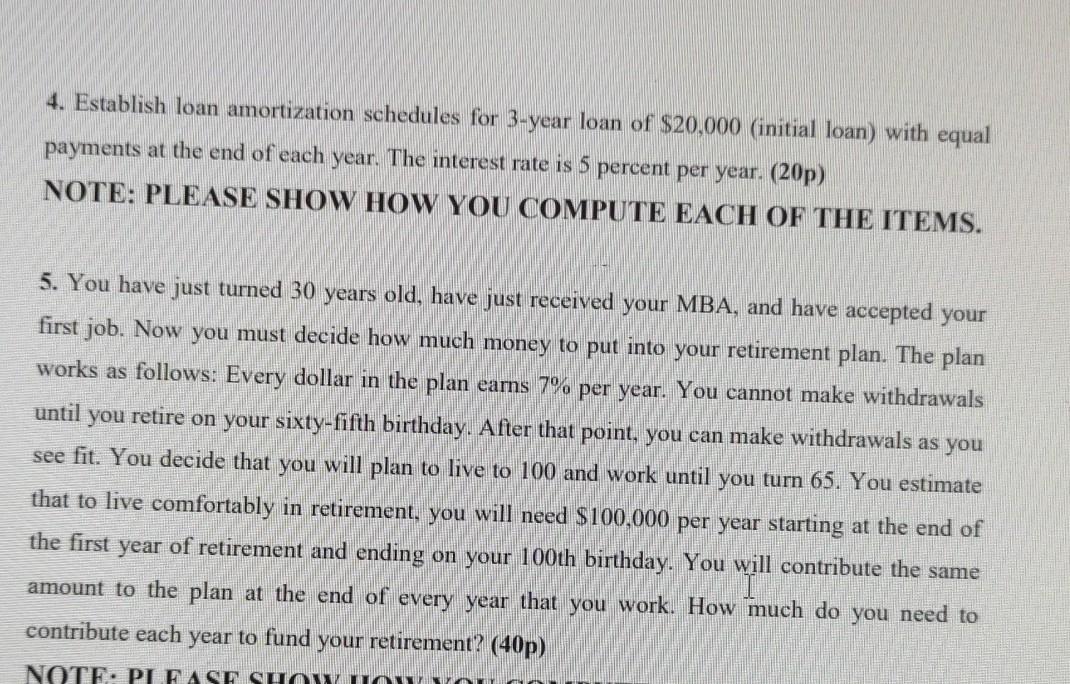

2. Table is given below shows that marginal tax rates for Alejandro Corporation. Taxable Income of the Company is equal to $44.000. How much will the Company pay tax totally? Average tax rate? (15p) NOTE: PLEASE SHOW HOW YOU COMPUTE EACH OF THE ITEMS. Taxable Income (S) Tax Rate 0 - 16.000 10% 16.000 39.000 12% 39.000 55.000 16% 55.000 70.000 19% 70.000 86.000 23% 3. Suppose that an investment promises to pay a real 9% annual rate of interest and inflation rate is 3%. What is the effective annual interest rate on this investment assuming that interest is compounded quarterly? (10p) 4. Establish loan amortization schedules for 3-year loan of $20,000 (initial loan) with equal payments at the end of each year. The interest rate is 5 percent per year. (20p) NOTE: PLEASE SHOW HOW YOU COMPUTE EACH OF THE ITEMS. 5. You have just turned 30 years old, have just received your MBA, and have accepted your first job. Now you must decide how much money to put into your retirement plan. The plan works as follows: Every dollar in the plan earns 7% per year. You cannot make withdrawals until you retire on your sixty-fifth birthday. After that point, you can make withdrawals as you see fit. You decide that you will plan to live to 100 and work until you turn 65. You estimate that to live comfortably in retirement, you will need $100.000 per year starting at the end of the first year of retirement and ending on your 100th birthday. You will contribute the same amount to the plan at the end of every year that you work. How much do you need to contribute each year to fund your retirement? (40p) NOTE: PLEASE SHO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts