Question: 2. The current term structure of quarterly compounding forward rates is given by f;(0)=0.01+0.0003* j, j =0,...,119. Use the Black formula to price a floor

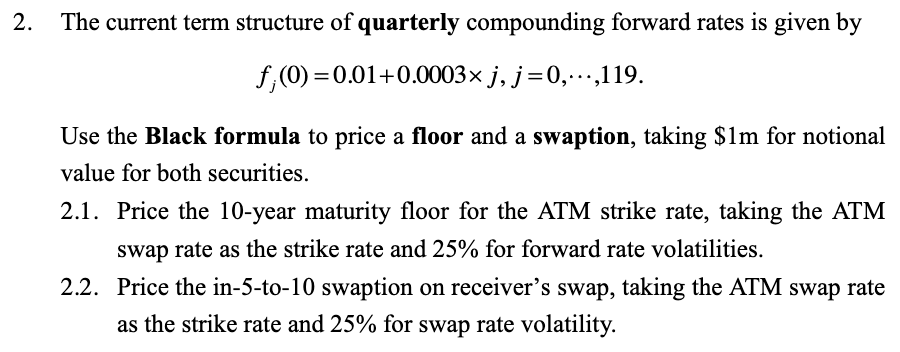

2. The current term structure of quarterly compounding forward rates is given by f;(0)=0.01+0.0003* j, j =0,...,119. Use the Black formula to price a floor and a swaption, taking $1m for notional value for both securities. 2.1. Price the 10-year maturity floor for the ATM strike rate, taking the ATM swap rate as the strike rate and 25% for forward rate volatilities. 2.2. Price the in-5-to-10 swaption on receiver's swap, taking the ATM swap rate as the strike rate and 25% for swap rate volatility. 2. The current term structure of quarterly compounding forward rates is given by f;(0)=0.01+0.0003* j, j =0,...,119. Use the Black formula to price a floor and a swaption, taking $1m for notional value for both securities. 2.1. Price the 10-year maturity floor for the ATM strike rate, taking the ATM swap rate as the strike rate and 25% for forward rate volatilities. 2.2. Price the in-5-to-10 swaption on receiver's swap, taking the ATM swap rate as the strike rate and 25% for swap rate volatility

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts