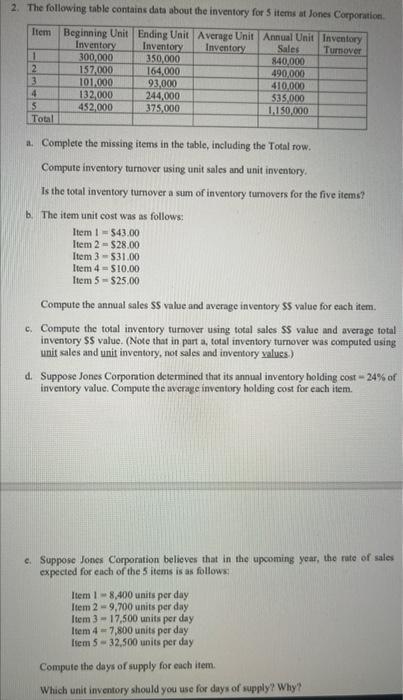

Question: 2. The following table contains data about the inventory for 5 items at Jones Corporation Item Beginning Unit Ending Unit Average Unit Annual Unit Inventory

2. The following table contains data about the inventory for 5 items at Jones Corporation Item Beginning Unit Ending Unit Average Unit Annual Unit Inventory Inventory Inventory Inventory Sales Turnover 1 300.000 350.000 840,000 2 157.000 164,000 490,000 3 101.000 93,000 410,000 4 132,000 244.000 535.000 5 452,000 375.000 1.150,000 Total a. Complete the missing items in the table, including the Total row. Compute inventory turnover using unit sales and unit inventory Is the total inventory tumover a sum of inventory tumovers for the five items! b. The item unit cost was as follows: Item 1543.00 Item 2 - $28.00 Item 3 - 531.00 Item 4-S10.00 Item 5 - $25.00 Compute the annual sales SS value and average inventory S5 value for each item. c. Compute the total inventory turnover using total sales $5 value and average total inventory SS value. (Note that in part a, total inventory turnover was computed using unit sales and unit inventory, not sales and inventory values) d. Suppose Jones Corporation determined that its annual inventory holding cost -24% of inventory value. Compute the average inventory holding cost for each item. c. Suppose Jones Corporation believes that in the upcoming year, the rate of sales expected for each of the 5 items is as follows: Item 1 -8,400 units per day Item 2 - 9,700 units per day Item 3 - 17,500 units per day Item 4-7,800 units per day Item 5 -32.500 units per day Compute the days of supply for each item. Which unit inventory should you use for days of supply? Why? 3. a. What is the benefit of cost of quality (COQ) analysis? b. Name and explain major cost categories identified by COQ. c. Describe how each type of cost would change (increase, decrease, or remain the same) if we designed a higher-quality product that was easier to manufacture. d. Why is quality at the source better than quality through inspection? 2. The following table contains data about the inventory for 5 items at Jones Corporation Item Beginning Unit Ending Unit Average Unit Annual Unit Inventory Inventory Inventory Inventory Sales Turnover 1 300.000 350.000 840,000 2 157.000 164,000 490,000 3 101.000 93,000 410,000 4 132,000 244.000 535.000 5 452,000 375.000 1.150,000 Total a. Complete the missing items in the table, including the Total row. Compute inventory turnover using unit sales and unit inventory Is the total inventory tumover a sum of inventory tumovers for the five items! b. The item unit cost was as follows: Item 1543.00 Item 2 - $28.00 Item 3 - 531.00 Item 4-S10.00 Item 5 - $25.00 Compute the annual sales SS value and average inventory S5 value for each item. c. Compute the total inventory turnover using total sales $5 value and average total inventory SS value. (Note that in part a, total inventory turnover was computed using unit sales and unit inventory, not sales and inventory values) d. Suppose Jones Corporation determined that its annual inventory holding cost -24% of inventory value. Compute the average inventory holding cost for each item. c. Suppose Jones Corporation believes that in the upcoming year, the rate of sales expected for each of the 5 items is as follows: Item 1 -8,400 units per day Item 2 - 9,700 units per day Item 3 - 17,500 units per day Item 4-7,800 units per day Item 5 -32.500 units per day Compute the days of supply for each item. Which unit inventory should you use for days of supply? Why? 3. a. What is the benefit of cost of quality (COQ) analysis? b. Name and explain major cost categories identified by COQ. c. Describe how each type of cost would change (increase, decrease, or remain the same) if we designed a higher-quality product that was easier to manufacture. d. Why is quality at the source better than quality through inspection