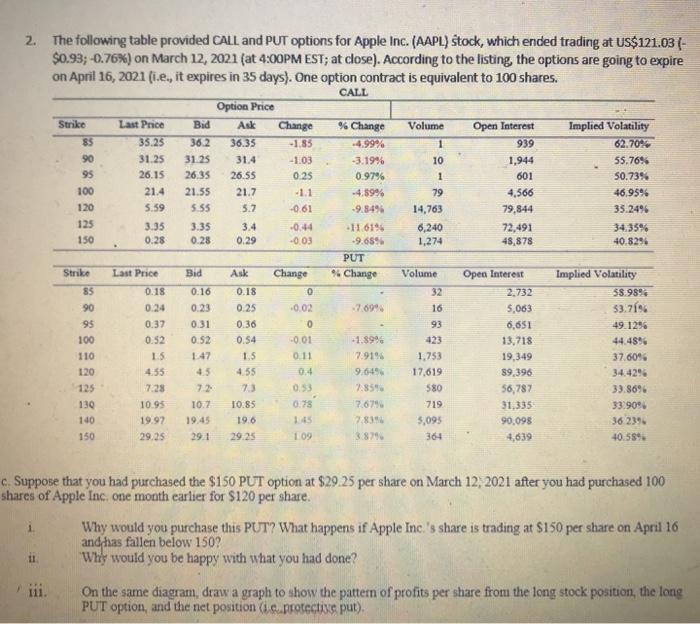

Question: 2. The following table provided CALL and PUT options for Apple Inc. (AAPL) stock, which ended trading at US$121.03(- $0.93; -0.76%) on March 12, 2021

2. The following table provided CALL and PUT options for Apple Inc. (AAPL) stock, which ended trading at US$121.03(- $0.93; -0.76%) on March 12, 2021 (at 4:00PM EST; at close). According to the listing the options are going to expire on April 16, 2021 (i.e., it expires in 35 days). One option contract is equivalent to 100 shares. CALL Option Price Strike Last Price Bid Ask Change % Change Volume Open Interest Implied Volatility 85 35.25 36.2 36.35 -1.85 14.99% 1 939 62.70% 90 31.25 31.25 31.4 -1.03 -3.19% 10 1,944 55.76% 95 26.15 26.35 26.55 0.25 0.97% 1 601 50.73% 100 21.4 21.55 21.7 -1.1 -4.39% 79 4,566 46.95% 120 5.59 5.55 5.7 -0.61 -9.9496 14,763 79,844 33.2496 125 3.35 3.35 3.4 -0.44 11 6196 6,240 72,491 34.35% 150 0.28 0.28 0.29 -0.03 -9.68% 1,274 48,878 40.8294 PUT Strike Last Price Bid Ask Change % Change Volume Open Interest Implied Volatility 85 0.18 0.16 0.18 0 2.732 58.98% 90 0.24 0.23 0.25 -0.02 7.6994 16 5,063 53.7194 95 0.37 0.31 0.36 0 93 6,651 49.1296 100 0.52 0.52 0.54 -0.01 -1.899 423 13,718 44.48% 110 1.5 1.47 1.5 0.11 7.9196 1,753 19,349 37.6096 120 4.55 4.55 0.4 17.619 89.396 34.4296 125 7.28 73 0.53 7.859 580 56,787 33.8694 130 10.95 10.7 10.85 0.78 7.6794 719 31.335 33.9094 140 19.92 19.45 19.6 145 7.839 5,095 90,098 36 2396 150 29.25 29.1 29.25 109 364 4,639 40.589 c. Suppose that you had purchased the $150 PUT option at $29.25 per share on March 12, 2021 after you had purchased 100 shares of Apple Inc one month earlier for $120 per share. Why would you purchase this PUT? What happens if Apple Inc.'s share is trading at $150 per share on April 16 and duas fallen below 150? 'Why would you be happy with what you had done? 111 On the same diagram, draw a graph to show the pattern of profits per share from the long stock position, the long PUT option, and the net position de protectie put) 2. The following table provided CALL and PUT options for Apple Inc. (AAPL) stock, which ended trading at US$121.03(- $0.93; -0.76%) on March 12, 2021 (at 4:00PM EST; at close). According to the listing the options are going to expire on April 16, 2021 (i.e., it expires in 35 days). One option contract is equivalent to 100 shares. CALL Option Price Strike Last Price Bid Ask Change % Change Volume Open Interest Implied Volatility 85 35.25 36.2 36.35 -1.85 14.99% 1 939 62.70% 90 31.25 31.25 31.4 -1.03 -3.19% 10 1,944 55.76% 95 26.15 26.35 26.55 0.25 0.97% 1 601 50.73% 100 21.4 21.55 21.7 -1.1 -4.39% 79 4,566 46.95% 120 5.59 5.55 5.7 -0.61 -9.9496 14,763 79,844 33.2496 125 3.35 3.35 3.4 -0.44 11 6196 6,240 72,491 34.35% 150 0.28 0.28 0.29 -0.03 -9.68% 1,274 48,878 40.8294 PUT Strike Last Price Bid Ask Change % Change Volume Open Interest Implied Volatility 85 0.18 0.16 0.18 0 2.732 58.98% 90 0.24 0.23 0.25 -0.02 7.6994 16 5,063 53.7194 95 0.37 0.31 0.36 0 93 6,651 49.1296 100 0.52 0.52 0.54 -0.01 -1.899 423 13,718 44.48% 110 1.5 1.47 1.5 0.11 7.9196 1,753 19,349 37.6096 120 4.55 4.55 0.4 17.619 89.396 34.4296 125 7.28 73 0.53 7.859 580 56,787 33.8694 130 10.95 10.7 10.85 0.78 7.6794 719 31.335 33.9094 140 19.92 19.45 19.6 145 7.839 5,095 90,098 36 2396 150 29.25 29.1 29.25 109 364 4,639 40.589 c. Suppose that you had purchased the $150 PUT option at $29.25 per share on March 12, 2021 after you had purchased 100 shares of Apple Inc one month earlier for $120 per share. Why would you purchase this PUT? What happens if Apple Inc.'s share is trading at $150 per share on April 16 and duas fallen below 150? 'Why would you be happy with what you had done? 111 On the same diagram, draw a graph to show the pattern of profits per share from the long stock position, the long PUT option, and the net position de protectie put)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts