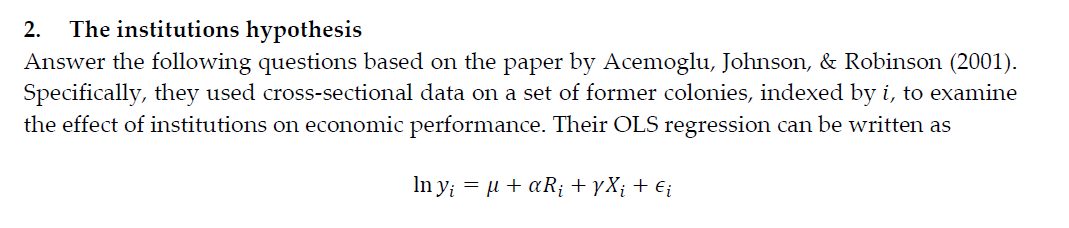

Question: 2. The institutions hypothesis Answer the following questions based on the paper by Acemoglu, Johnson, & Robinson (2001). Specifically, they used cross-sectional data on a

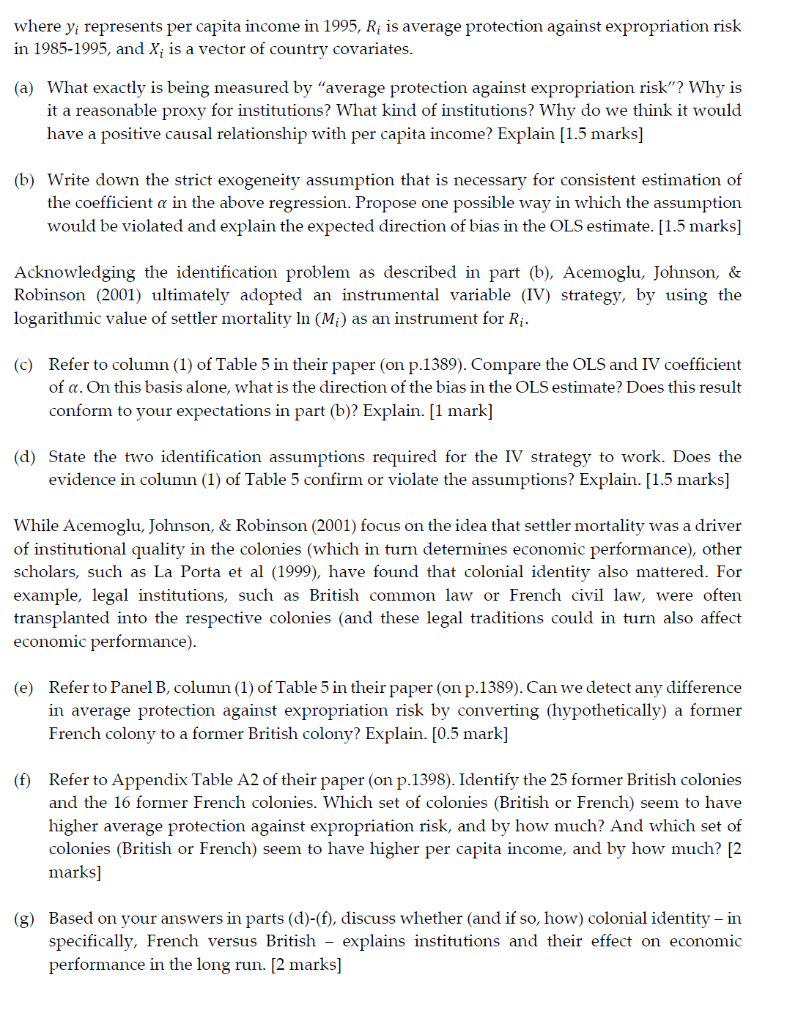

2. The institutions hypothesis Answer the following questions based on the paper by Acemoglu, Johnson, & Robinson (2001). Specifically, they used cross-sectional data on a set of former colonies, indexed by i, to examine the effect of institutions on economic performance. Their OLS regression can be written as In yi = pi + aR; +yX; + Ei where yi represents per capita income in 1995, R; is average protection against expropriation risk in 1985-1995, and Xi is a vector of country covariates. (a) What exactly is being measured by average protection against expropriation risk"? Why is it a reasonable proxy for institutions? What kind of institutions? Why do we think it would have a positive causal relationship with per capita income? Explain (1.5 marks] (b) Write down the strict exogeneity assumption that is necessary for consistent estimation of the coefficient a in the above regression. Propose one possible way in which the assumption would be violated and explain the expected direction of bias in the OLS estimate. [1.5 marks] Acknowledging the identification problem as described in part (b), Acemoglu, Johnson, & Robinson (2001) ultimately adopted an instrumental variable (IV) strategy, by using the logarithmic value of settler mortality In (M;) as an instrument for Ri. (c) Refer to column (1) of Table 5 in their paper (on p.1389). Compare the OLS and IV coefficient of a. On this basis alone, what is the direction of the bias in the OLS estimate? Does this result conform to your expectations in part (b)? Explain. [1 mark] (d) State the two identification assumptions required for the IV strategy to work. Does the evidence in column (1) of Table 5 confirm or violate the assumptions? Explain. [1.5 marks) While Acemoglu, Johnson, & Robinson (2001) focus on the idea that settler mortality was a driver of institutional quality in the colonies (which in turn determines economic performance), other scholars, such as La Porta et al (1999), have found that colonial identity also mattered. For example, legal institutions, such as British common law or French civil law, were often transplanted into the respective colonies (and these legal traditions could in turn also affect economic performance). (e) Refer to Panel B, column (1) of Table 5 in their paper (on p.1389). Can we detect any difference in average protection against expropriation risk by converting (hypothetically) a former French colony to a former British colony? Explain. [0.5 mark] (f) Refer to Appendix Table A2 of their paper (on p.1398). Identify the 25 former British colonies and the 16 former French colonies. Which set of colonies (British or French) seem to have higher average protection against expropriation risk, and by how much? And which set of colonies (British or French) seem to have higher per capita income, and by how much? [2 marks] (g) Based on your answers in parts (d)-(f), discuss whether (and if so, how) colonial identity - in specifically, French versus British - explains institutions and their effect on economic performance in the long run. [2 marks] 2. The institutions hypothesis Answer the following questions based on the paper by Acemoglu, Johnson, & Robinson (2001). Specifically, they used cross-sectional data on a set of former colonies, indexed by i, to examine the effect of institutions on economic performance. Their OLS regression can be written as In yi = pi + aR; +yX; + Ei where yi represents per capita income in 1995, R; is average protection against expropriation risk in 1985-1995, and Xi is a vector of country covariates. (a) What exactly is being measured by average protection against expropriation risk"? Why is it a reasonable proxy for institutions? What kind of institutions? Why do we think it would have a positive causal relationship with per capita income? Explain (1.5 marks] (b) Write down the strict exogeneity assumption that is necessary for consistent estimation of the coefficient a in the above regression. Propose one possible way in which the assumption would be violated and explain the expected direction of bias in the OLS estimate. [1.5 marks] Acknowledging the identification problem as described in part (b), Acemoglu, Johnson, & Robinson (2001) ultimately adopted an instrumental variable (IV) strategy, by using the logarithmic value of settler mortality In (M;) as an instrument for Ri. (c) Refer to column (1) of Table 5 in their paper (on p.1389). Compare the OLS and IV coefficient of a. On this basis alone, what is the direction of the bias in the OLS estimate? Does this result conform to your expectations in part (b)? Explain. [1 mark] (d) State the two identification assumptions required for the IV strategy to work. Does the evidence in column (1) of Table 5 confirm or violate the assumptions? Explain. [1.5 marks) While Acemoglu, Johnson, & Robinson (2001) focus on the idea that settler mortality was a driver of institutional quality in the colonies (which in turn determines economic performance), other scholars, such as La Porta et al (1999), have found that colonial identity also mattered. For example, legal institutions, such as British common law or French civil law, were often transplanted into the respective colonies (and these legal traditions could in turn also affect economic performance). (e) Refer to Panel B, column (1) of Table 5 in their paper (on p.1389). Can we detect any difference in average protection against expropriation risk by converting (hypothetically) a former French colony to a former British colony? Explain. [0.5 mark] (f) Refer to Appendix Table A2 of their paper (on p.1398). Identify the 25 former British colonies and the 16 former French colonies. Which set of colonies (British or French) seem to have higher average protection against expropriation risk, and by how much? And which set of colonies (British or French) seem to have higher per capita income, and by how much? [2 marks] (g) Based on your answers in parts (d)-(f), discuss whether (and if so, how) colonial identity - in specifically, French versus British - explains institutions and their effect on economic performance in the long run. [2 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts