Question: ( 2 ) The land had been held for approximately three years. It had been held vacant in order to realize a profit on its

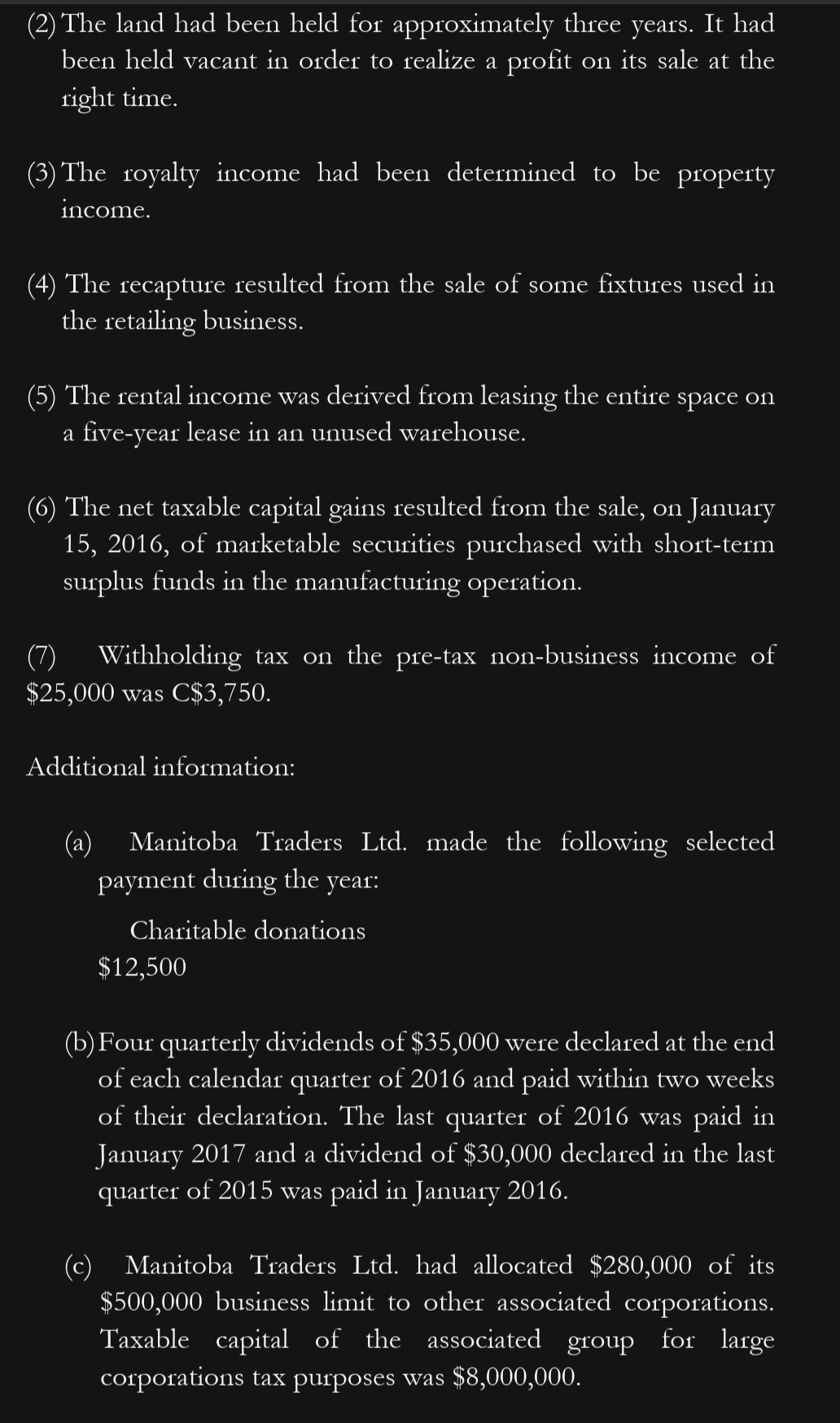

The land had been held for approximately three years. It had been held vacant in order to realize a profit on its sale at the right time.

The royalty income had been determined to be property income.

The recapture resulted from the sale of some fixtures used in the retailing business.

The rental income was derived from leasing the entire space on a fiveyear lease in an unused warehouse.

The net taxable capital gains resulted from the sale, on January of marketable securities purchased with shortterm surplus funds in the manufacturing operation.

Withholding tax on the pretax nonbusiness income of $ was $

Additional information:

a Manitoba Traders Ltd made the following selected payment during the year:

Charitable donations

$

bFour quarterly dividends of $ were declared at the end of each calendar quarter of and paid within two weeks of their declaration. The last quarter of was paid in January and a dividend of $ declared in the last quarter of was paid in January

c Manitoba Traders Ltd had allocated $ of its $ business limit to other associated corporations. Taxable capital of the associated group for large corporations tax purposes was $

d The balance in the tax accounts on January were:

tableCharitable donation carryforward,$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock