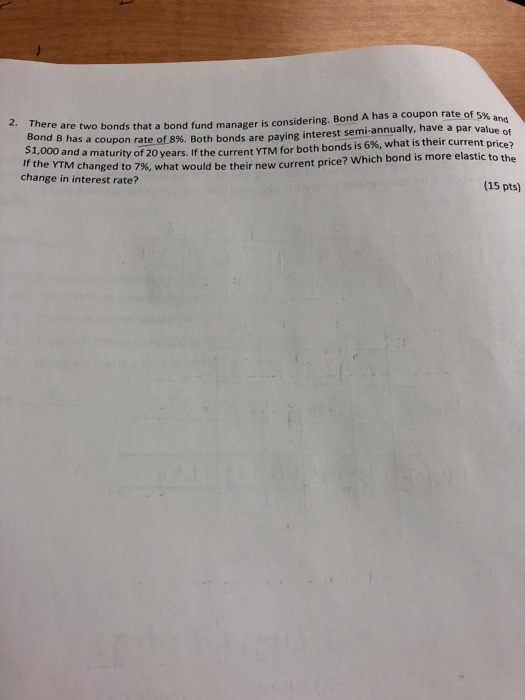

Question: 2. There are two bonds that a bond fund manager is considering. Bond A has a coupon rate of 5% and Bond B has a

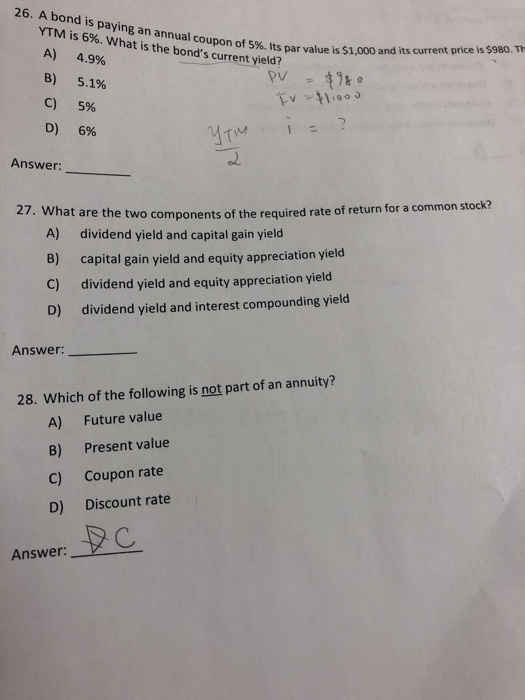

2. There are two bonds that a bond fund manager is considering. Bond A has a coupon rate of 5% and Bond B has a coupon rate of 8 %. Both bonds are paying interest semi-annually, have a par value of $1,000 anda maturity of 20 years. If the current YTM for both bonds is 6%, what is their current price? If the YTM changed to 7% , what would be their new current price? Which bond is more elastic to the change in interest rate? (15 pts) 26. A bond is paying an annual coupon of 5%. Its par value is $1,000 and its current price is $980. T YTM is 6%. What is the bond's current yield? A) 4.9% $780 Ev-t100 B) 5.1 % C) 5% D) 6% TM Answer: 27. What are the two components of the required rate of return for a common stock? A) dividend yield and capital gain yield B) capital gain yield and equity appreciation yield C) dividend yield and equity appreciation yield D) dividend yield and interest compounding yield Answer: 28. Which of the following is not part of an annuity? Future value A) Present value B) Coupon rate C) Discount rate D)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts