Question: 2. This problem illustrates the (positive) effect of multimarket contact on the feasibility of collusion. Also, Consider an infinitely repeated Bertrand game with homogeneous

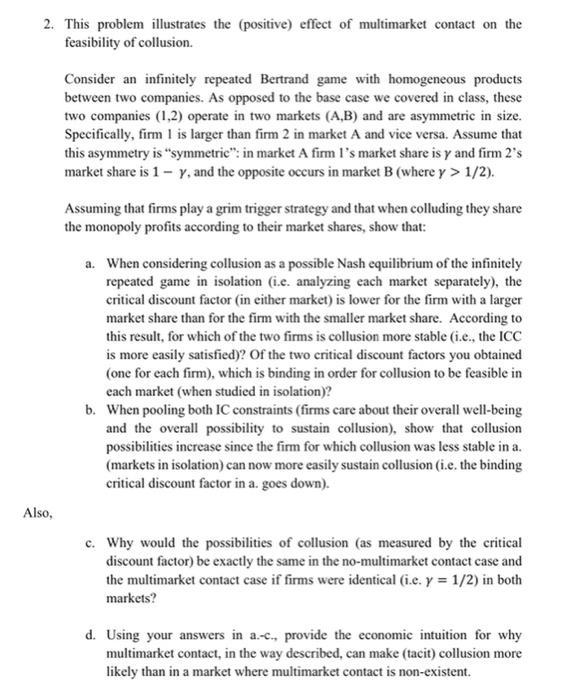

2. This problem illustrates the (positive) effect of multimarket contact on the feasibility of collusion. Also, Consider an infinitely repeated Bertrand game with homogeneous products between two companies. As opposed to the base case we covered in class, these two companies (1,2) operate in two markets (A,B) and are asymmetric in size. Specifically, firm 1 is larger than firm 2 in market A and vice versa. Assume that this asymmetry is "symmetric": in market A firm I's market share is y and firm 2's market share is 1- y, and the opposite occurs in market B (where y > 1/2). Assuming that firms play a grim trigger strategy and that when colluding they share the monopoly profits according to their market shares, show that: a. When considering collusion as a possible Nash equilibrium of the infinitely repeated game in isolation (i.e. analyzing each market separately), the critical discount factor (in either market) is lower for the firm with a larger market share than for the firm with the smaller market share. According to this result, for which of the two firms is collusion more stable (i.e., the ICC is more easily satisfied)? Of the two critical discount factors you obtained (one for each firm), which is binding in order for collusion to be feasible in each market (when studied in isolation)? b. When pooling both IC constraints (firms care about their overall well-being and the overall possibility to sustain collusion), show that collusion possibilities increase since the firm for which collusion was less stable in a. (markets in isolation) can now more easily sustain collusion (i.e. the binding critical discount factor in a. goes down). c. Why would the possibilities of collusion (as measured by the critical discount factor) be exactly the same in the no-multimarket contact case and the multimarket contact case if firms were identical (i.e. y = 1/2) in both markets? d. Using your answers in a.-c., provide the economic intuition for why multimarket contact, in the way described, can make (tacit) collusion more likely than in a market where multimarket contact is non-existent.

Step by Step Solution

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Answer a The reason why the critical discount factor is lower for the firm with a larger market share is because a larger market share gives the firm a greater incentive to deviate from the collusive ... View full answer

Get step-by-step solutions from verified subject matter experts