Question: 2. Todd is able to pay $170 a month for 5 years for a car. If the interest rate is 3.4 percent, how much can

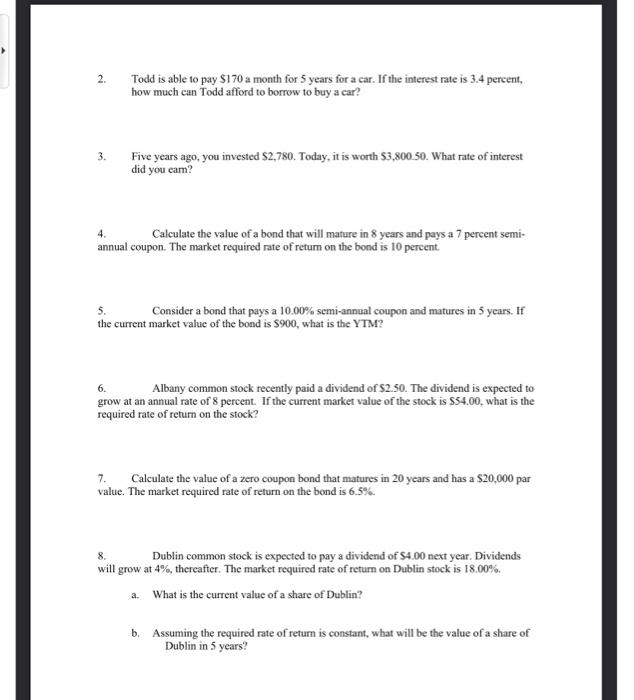

2. Todd is able to pay $170 a month for 5 years for a car. If the interest rate is 3.4 percent, how much can Todd afford to borrow to buy a car? 3. Five years ago, you invested $2,780. Today, it is worth $3,800.50. What rate of interest did you eam? 4. Calculate the value of a bond that will mature in 8 years and pays a 7 percent semi- annual coupon. The market required rate of return on the bond is 10 percent. 5. Consider a bond that pays a 10.00% semi-annual coupon and matures in 5 years. If the current market value of the bond is $900, what is the YTM? 6. Albany common stock recently paid a dividend of $2.50. The dividend is expected to grow at an annual rate of 8 percent. If the current market value of the stock is $54.00, what is the required rate of return on the stock? 7. Calculate the value of a zero coupon bond that matures in 20 years and has a $20,000 par value. The market required rate of return on the bond is 6.5%. 8. Dublin common stock is expected to pay a dividend of $4.00 next year. Dividends will grow at 4%, thereafter. The market required rate of return on Dublin stock is 18.00% a. What is the current value of a share of Dublin? b. Assuming the required rate of return is constant, what will be the value of a share of Dublin in 5 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts