Question: 2. Treasury Inflation Protected Securities (TIPS) make payments that are indexed to the consumer price index. Consider a bond that pays $1000 in one year

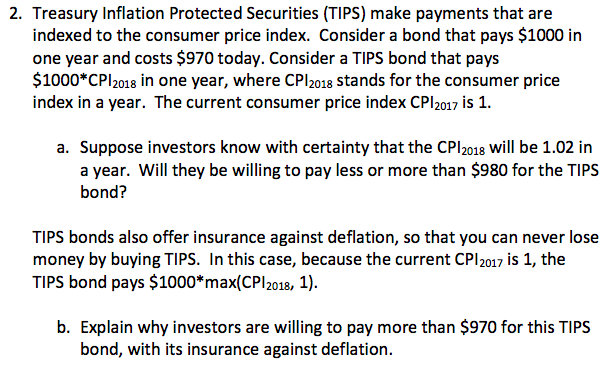

2. Treasury Inflation Protected Securities (TIPS) make payments that are indexed to the consumer price index. Consider a bond that pays $1000 in one year and costs $970 today. Consider a TIPS bond that pays 1000*CPl2018 in one year, where CP/2018 stands for the consumer price index in a year. The current consumer price index CPl2017 is 1. a. Suppose investors know with certainty that the CPl2018 will be 1.02 in a year. Will they be willing to pay less or more than $980 for the TIPS bond? TIPS bonds also offer insurance against deflation, so that you can never lose money by buying TIPS. In this case, because the current CPI2017 is 1, the TIPS bond pays $1000*max(CPl2018, 1). b. Explain why investors are willing to pay more than $970 for this TIPS bond, with its insurance against deflation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts