Question: Please write down the steps and formula. TYMy Acc... Schedule Builder canvas dashboard CUC DAVIS GRADU... Question 13 7 pts Suppose the spot price for

Please write down the steps and formula.

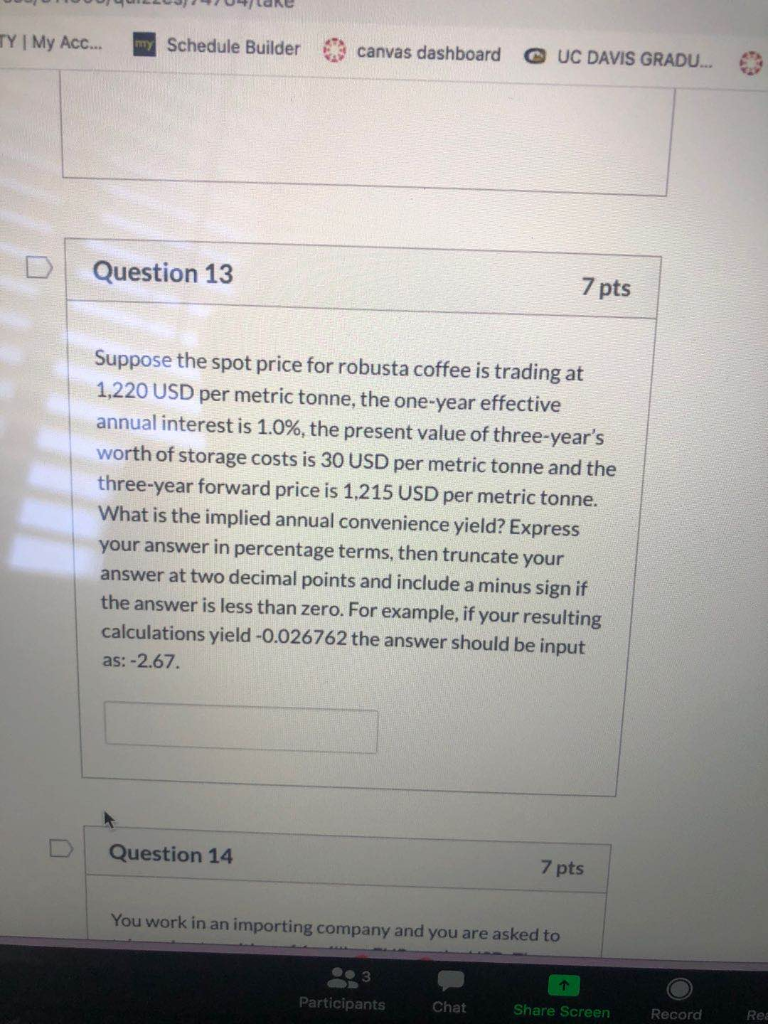

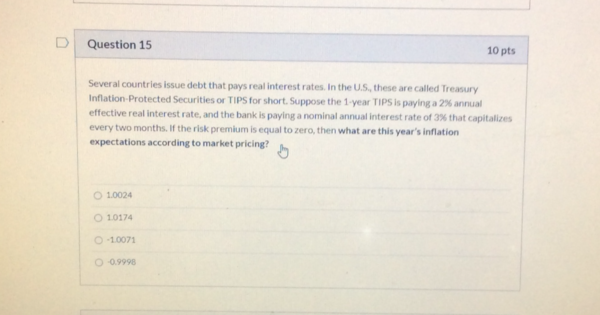

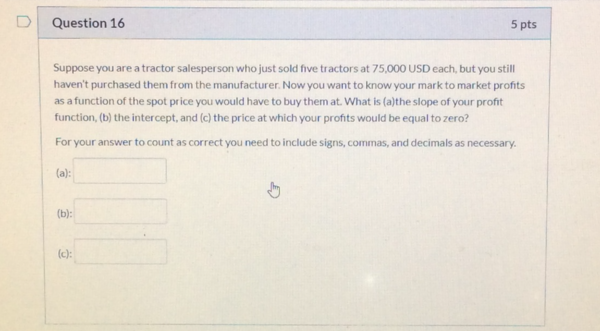

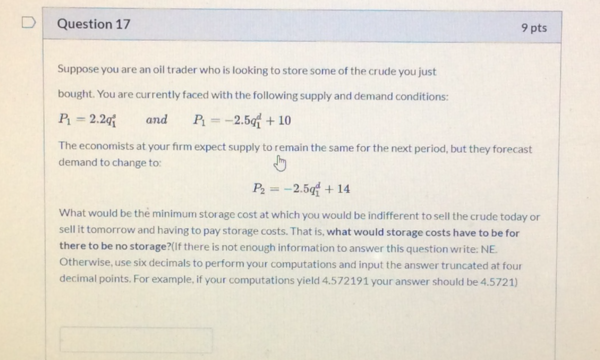

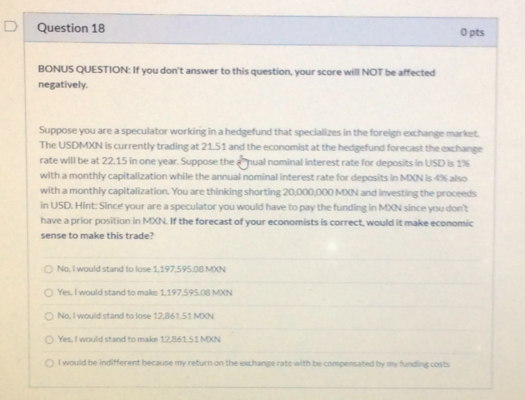

TYMy Acc... Schedule Builder canvas dashboard CUC DAVIS GRADU... Question 13 7 pts Suppose the spot price for robusta coffee is trading at 1,220 USD per metric tonne, the one-year effective annual interest is 1.0%, the present value of three-year's worth of storage costs is 30 USD per metric tonne and the three-year forward price is 1,215 USD per metric tonne. What is the implied annual convenience yield? Express your answer in percentage terms, then truncate your answer at two decimal points and include a minus sign if the answer is less than zero. For example, if your resulting calculations yield -0.026762 the answer should be input as: -2.67 Question 14 7 pts You work in an importing company and you are asked to 3 Participants Chat Share Screen Record Ree D Question 15 10 pts Several countries issue debt that pays real interest rates. In the US, these are called Treasury Inflation Protected Securities or TIPS for short. Suppose the 1-year TIPS is paying a 2% annual effective real interest rate, and the bank is paying a nominal annual interest rate of 3% that capitalizes every two months. If the risk premium is equal to zero, then what are this year's inflation expectations according to market pricing? 10024 10174 1.0071 0.9998 Question 16 5 pts Suppose you are a tractor salesperson who just sold five tractors at 75,000 USD each, but you still haven't purchased them from the manufacturer. Now you want to know your mark to market profits as a function of the spot price you would have to buy them at. What is (a)the slope of your profit function, (b) the intercept, and (c) the price at which your profits would be equal to zero? For your answer to count as correct you need to include signs, commas, and decimals as necessary. (a): (b): (c): Question 17 9 pts Suppose you are an oil trader who is looking to store some of the crude you just bought. You are currently faced with the following supply and demand conditions: P1 = 2.241 and P1 = -2.501 + 10 The economists at your firm expect supply to remain the same for the next period, but they forecast demand to change to: P2 = -2.50 +14 What would be the minimum storage cost at which you would be indifferent to sell the crude today or sell it tomorrow and having to pay storage costs. That is, what would storage costs have to be for there to be no storage? (If there is not enough information to answer this question write: NE Otherwise, use six decimals to perform your computations and input the answer truncated at four decimal points. For example, if your computations yield 4.572191 your answer should be 4.5721) Question 18 O pts BONUS QUESTION: If you don't answer to this question, your score will NOT be affected negatively. Suppose you are a speculator working in a hedgefund that specializes in the foreign exchange market. The USDMXN is currently trading at 21.51 and the economist at the hedgefund forecast the exchange rate will be at 22.15 in one year. Suppose the Gual nominal interest rate for deposits in USD is 195 with a monthly capitalization while the annual nominal interest rate for deposits in MXN is also with a monthly capitalization. You are thinking shorting 20,000,000 MXN and investing the proceeds in USD. Hint: Since your are a speculator you would have to pay the funding in MN since you don't have a prior position in MXN. If the forecast of your economists is correct, would it make economic sense to make this trade? No, I would stand to lose 1.197.595.00 MXN Yes, I would stand to make 1.197.595.08 MON No, I would stand to lose 12861.51 MON Yes, I would stand to make 12.86151 MON I would be indifferent because my return on the change rate with be compensated by costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts