Question: 2. Trinomial Option Pricing Model The trinomial tree option pricing method is like the binomial tree option pricing model with a difference that the price

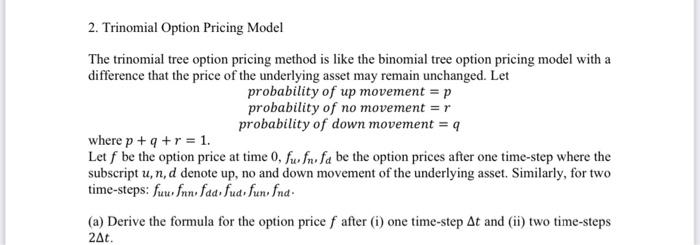

2. Trinomial Option Pricing Model The trinomial tree option pricing method is like the binomial tree option pricing model with a difference that the price of the underlying asset may remain unchanged. Let probability of up movement = p probability of no movement = r probability of down movement = 9 where p + q + r = 1. Let f be the option price at time 0, frufa be the option prices after one time-step where the subscript u, n,d denote up, no and down movement of the underlying asset. Similarly, for two time-steps: fuu.fun faa fua, fun, fnd. (a) Derive the formula for the option price f after (i) one time-step At and (ii) two time-steps 2t

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts