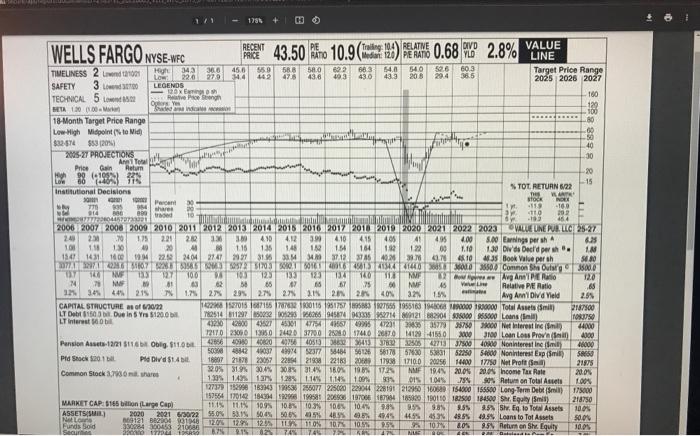

Question: 2. Use the CAPM model to calculate the required return for Wells Fargo with the beta given in the report. Assume risk free rate is

![rate is 0.5% and market return is 9%. [ 10 points] 3.](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ed65abf1ec7_09166ed65ab88000.jpg)

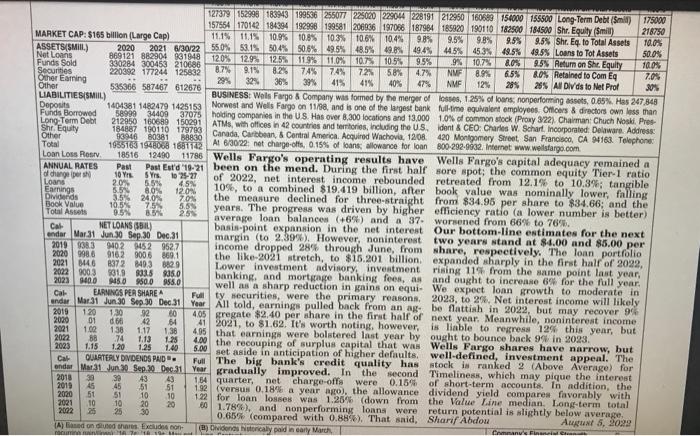

2. Use the CAPM model to calculate the required return for Wells Fargo with the beta given in the report. Assume risk free rate is 0.5% and market return is 9%. [ 10 points] 3. You can assume now is the end of 2021. All dividends are paid at the end of each year (2021 dividend has just been paid). To calculate the intrinsic value as of 12/31/2021, you first forecast future dividend payments. Value Line will provide you with forecasted dividends for 2022 and 2025-2027; You can assume the forecasted dividend for 2025-2027 is for year 2026. Treat the forecasted dividends for 2022 and 2026 as the starting and ending points, and use linear interpolation method (assuming equal changing amounts between periods) to forecast the dividends between the two time points. Clearly state your assumptions and show your work. [ 20 points]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts