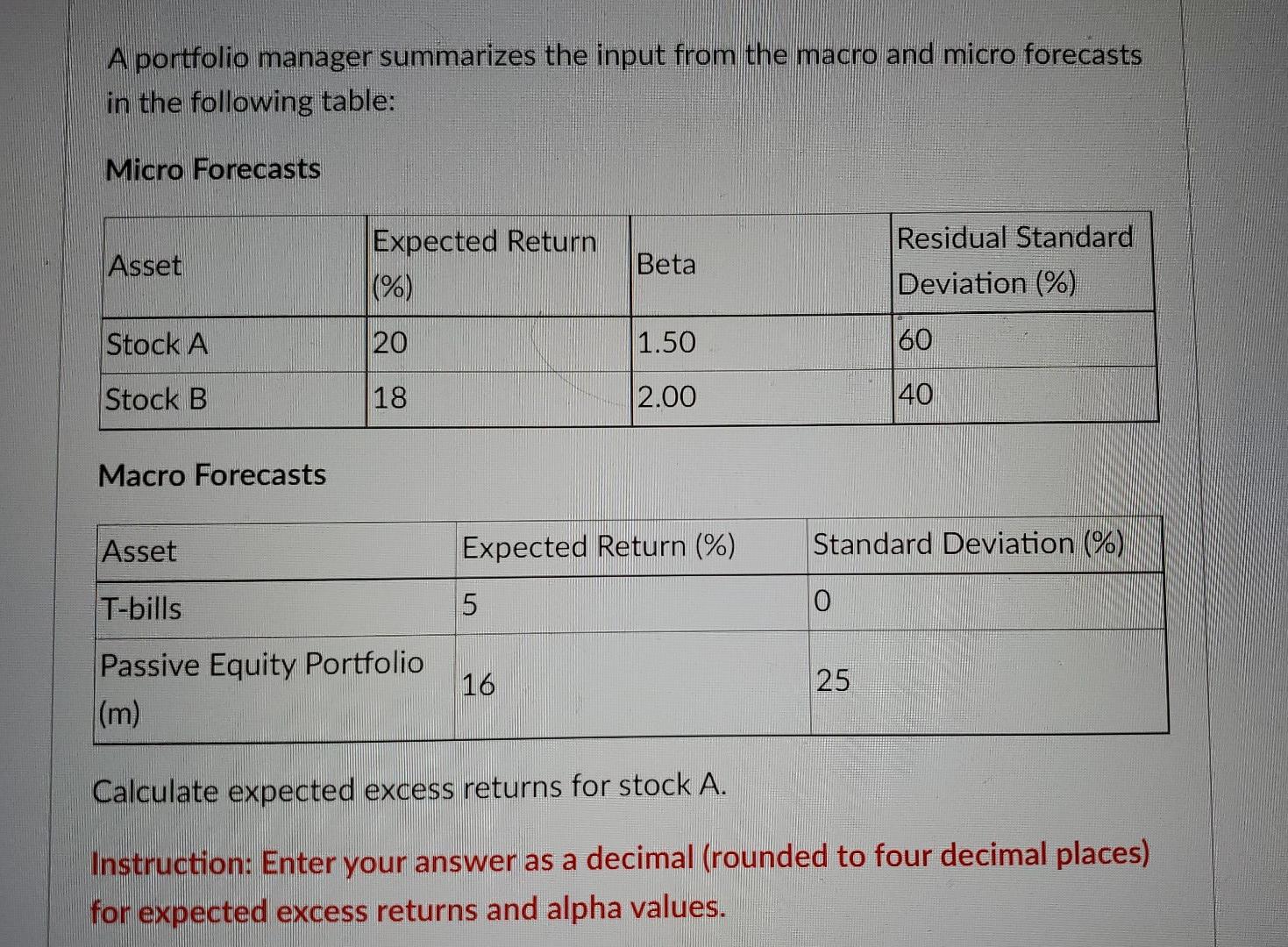

Question: a) Calculate expected excess returns for stock A. b) Calculate expected excess returns for stock B. c) Calculate expected alpha values for stock A. d)

a) Calculate expected excess returns for stock A.

b) Calculate expected excess returns for stock B.

c) Calculate expected alpha values for stock A.

d) Calculate expected alpha value for stock B.

e) Calculate expected residual variances for stock A.

f) Calculate expected residual variances for B.

A portfolio manager summarizes the input from the macro and micro forecasts in the following table: Micro Forecasts Asset Expected Return %) Beta Residual Standard Deviation (%) Stock A 20 1.50 60 Stock B 18 2.00 40 Macro Forecasts Asset Expected Return (%) Standard Deviation %) T-bills 5 0 Passive Equity Portfolio (m) 16 25 Calculate expected excess returns for stock A. Instruction: Enter your answer as a decimal (rounded to four decimal places) for expected excess returns and alpha values

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts