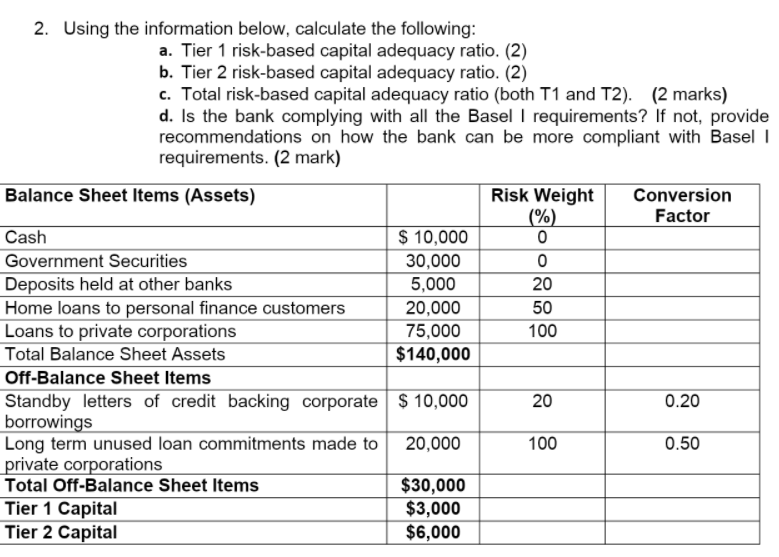

Question: 2. Using the information below, calculate the following: a. Tier 1 risk-based capital adequacy ratio. (2) b. Tier 2 risk-based capital adequacy ratio. (2) c.

2. Using the information below, calculate the following: a. Tier 1 risk-based capital adequacy ratio. (2) b. Tier 2 risk-based capital adequacy ratio. (2) c. Total risk-based capital adequacy ratio (both T1 and T2). (2 marks) d. Is the bank complying with all the Basel I requirements? If not, provide recommendations on how the bank can be more compliant with Basel I requirements. (2 mark) Balance Sheet Items (Assets) Conversion Factor Risk Weight (%) 0 0 20 50 100 Cash $ 10,000 Government Securities 30,000 Deposits held at other banks 5,000 Home loans to personal finance customers 20,000 Loans to private corporations 75,000 Total Balance Sheet Assets $140,000 Off-Balance Sheet Items Standby letters of credit backing corporate $ 10,000 borrowings Long term unused loan commitments made to 20,000 private corporations Total Off-Balance Sheet Items $30,000 Tier 1 Capital $3,000 Tier 2 Capital $6,000 20 0.20 100 0.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts